Retail Investors are always confused about what exactly is a Demat account and what are its benefits, let us discuss Demat account in detail.

What is a Demat Account?

A Demat account or a Dematerialized account is an account which holds your financial securities (equity or debt) in electronic form. India adopted this system after the Depository Act of 1996, thus eliminating the troubles associated with paper shares.

This made the process of sales, purchases and transfer quite easy as it only took 2-3 clicks, and the transaction was done. It also mitigated the risk associated with paper certificates.

watch our video to learn about the Demat account

Types of Demat Account:

There are three types of Demat accounts, namely:

- Regular Demat Account: This is a regular account that can be used by investors residing and citizens of India.

- Repatriable Demat Account: This account is used by NRI’s (Non-resident Indians) under which funds can be transferred abroad. This account requires and NRE bank associated with it.

- Non-Repatriable Demat Account: This account is used by NRI’s (Non-resident Indians) under which funds cannot be transferred abroad. This account requires and NRO bank associated with it.

Depository and Depository Participants: There are primarily two different entities involved in Demat accounts:

Depository: Depositories are responsible for managing the financial investment portfolio of investors. There are two depositories in India they are NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited)

Depository Participant: The DPs or Depository Participants are intermediaries between the account holder and the Central Depository; they can be Commercial Banks, Brokerage firms, and other Financial Institutions.

Benefits of Demat Account:

There are various benefits of owning a Demat Account; they are:

- It is one of the simplest ways to hold securities.

- It is safer than paper share as it eliminates the risk of wrong delivery, fake securities, thefts, delays etc.

- Saves the cost and efforts of paperwork

- It provides the user with remote access benefits, in case the user has linked his net banking with the appropriate financial institute.

- A single Demat account can hold investments in both equity & debt instruments.

Benefit to the Investor: The depository system reduces the risk of theft, loss, mutilation or forgery etc. It ensures safer and faster communication to investors.

Documents required for opening an account:

You broadly require two kinds of documents to open an account.

1) Identity proof:

- PAN Card

- Voter’s ID

- Passport

- Driving License

- Aadhaar Card

ID cards with applicant’s photo issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities, or professional bodies such as ICAI, ICWAI, ICSI, bar council etc.

2) Address proof

- Ration card

- Passport

- Voter ID card,

- Driving license,

- Bank passbook or Bank statement

- Verified copies of electricity bills or residence telephone bills,

- Leave and license agreement or agreement for sale

Self-declaration by High Court or Supreme Court judges, identity card or a document with address issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities and professional bodies such as ICAI, ICWAI, Bar Council etc.

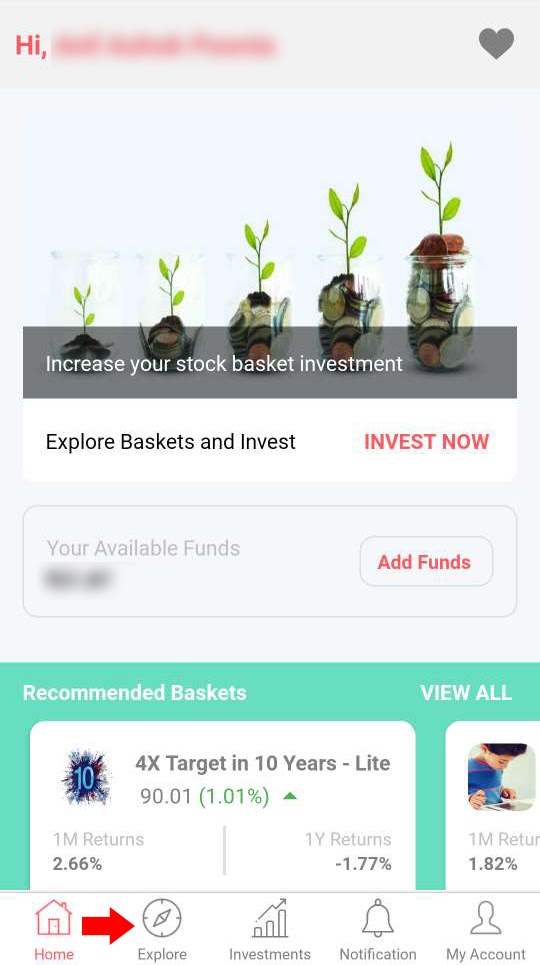

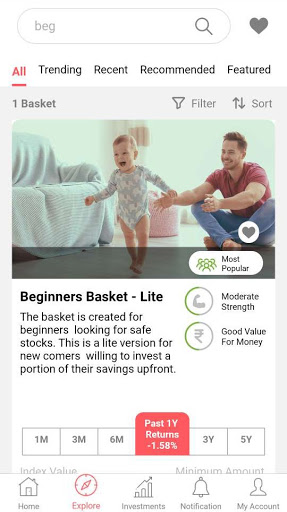

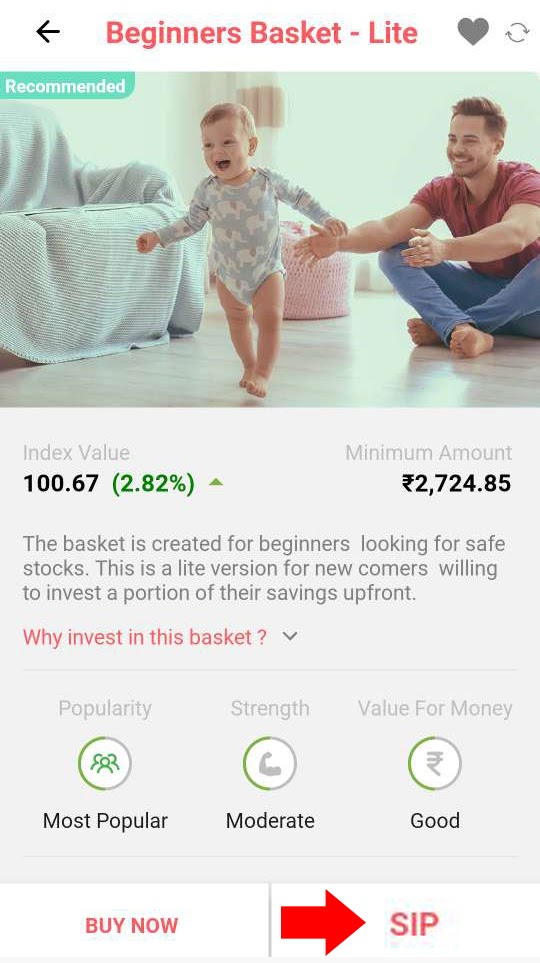

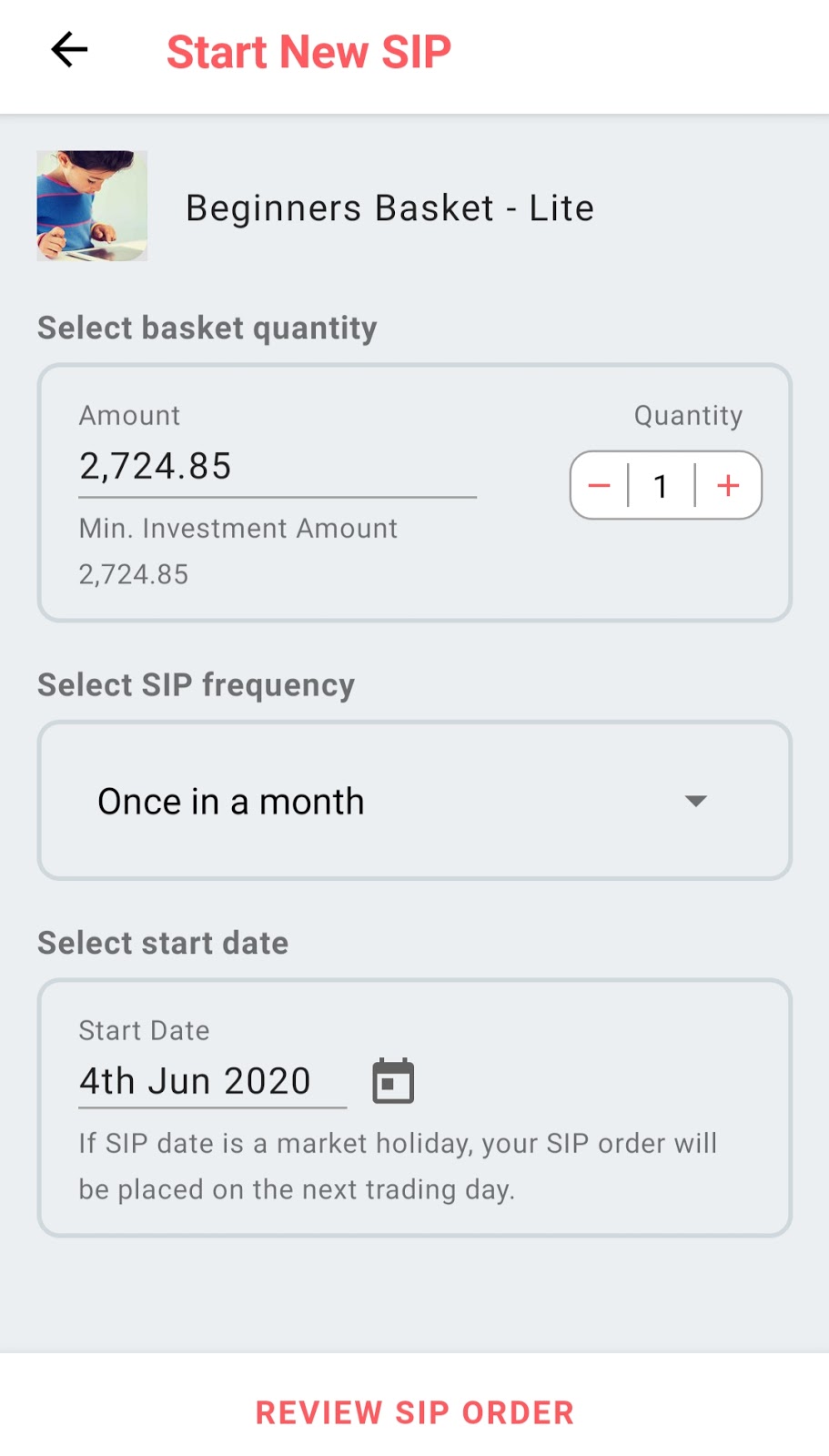

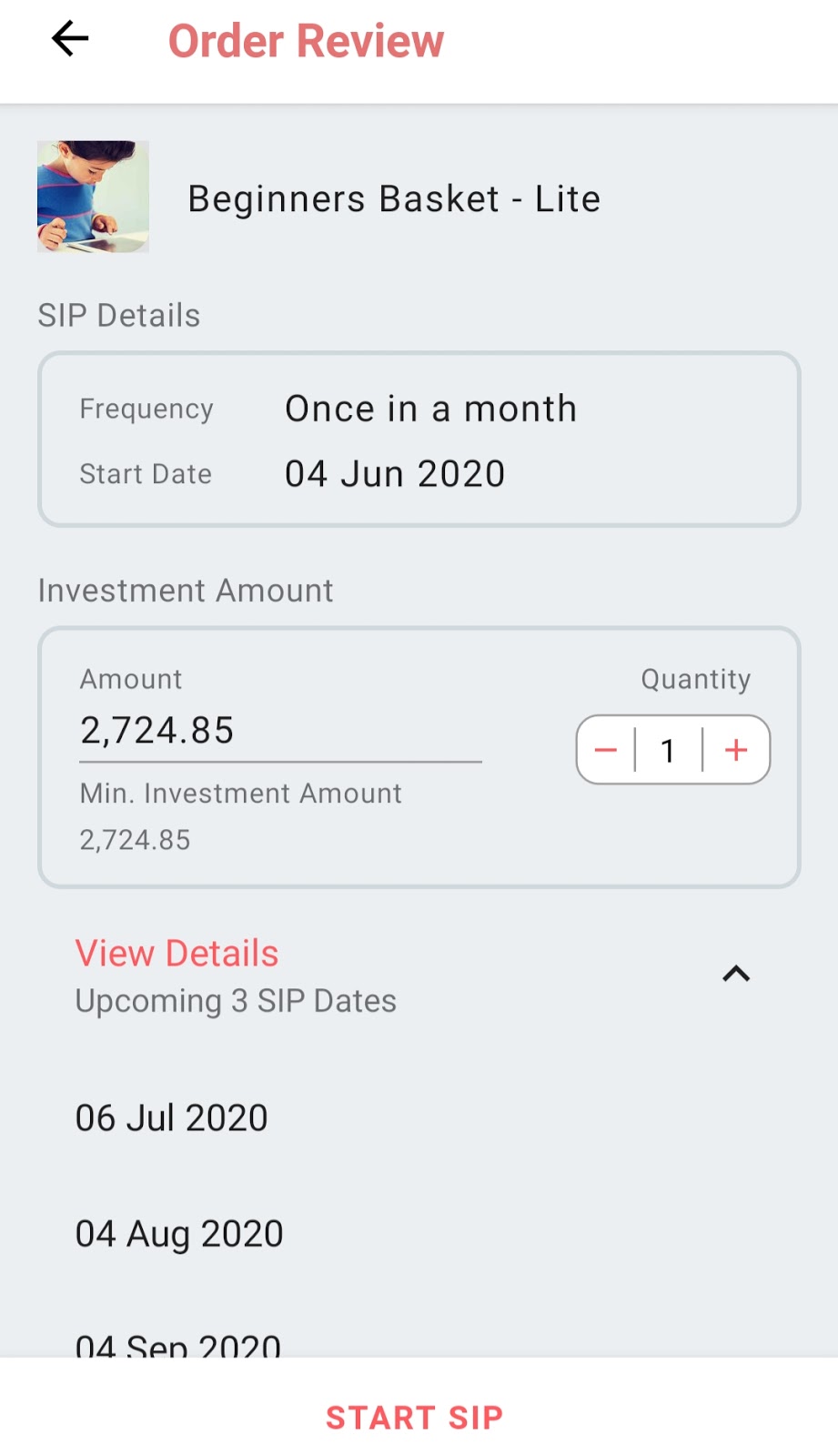

How to Open a Demat Account?

Now we will answer the most important question of how can retail investors open their account:

Step 1: Select a Depository participant (eg. Samco Securities)

Step 2: Full up all the details and upload the documents mentioned above.

Step 3: Submit your form and required documents.

Remember your PAN card is compulsory for opening your Account

Step 4: There will be an in-person verification by an employee of the Depository participant

Step 5: Account Number and details provided by the Depository Participant

With this, I conclude the blog hope you found the information useful.

Read more on: