On 26 January 2020, the whole world was grieving, mourning over the loss of Kobe Bryant, aka “The Mamba”.

Who was Kobe Bryant?

Kobe was an American Professional Basketball Player. He played his entire 20-year career in the National Basketball Association (NBA) with Los Angeles Lakers and won 5 NBA championships.

He was an 18-time All-Star, 15-time member of the All-NBA Team, 12-time member of the All-Defensive team, and the 2008 NBA Most Valuable Player (MVP). Apart from this, he is also known to the business world as a brand-builder, an investor and a coach to other athletes and company founders.

But most importantly he was famous for his attitude, and his so-called “Mamba Mentality”

What is the Mamba Mentality?

According to Kobe, the Mamba Mentality is a mindset that extends way beyond basketball or sports.

“We don’t quit,

We don’t cower,

We don’t run,

We endure & conquer

That’s Mamba Mentality”

It’s simple, if you have a goal or a dream, you need to apply the Mamba Mentality to achieve it. Everything worth achieving needs total focus and dedication.

Did you know: Kobe Bryant once said that he wanted to be remembered more for investing than basketball.

What investors can learn from him?

Mamba Mentality is all about focusing on the process, trusting in the hard work and perseverance when it comes to wealth creation in the Stock Market, the same thing is expected from every investor.

Investment Mentality & Mamba Mentality goes in parallel. If you really want to create wealth you must invest in top stocks and hold them for the long term with the magic of compounding coming in and helping you build a huge corpus. As Paul Samuelson said “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

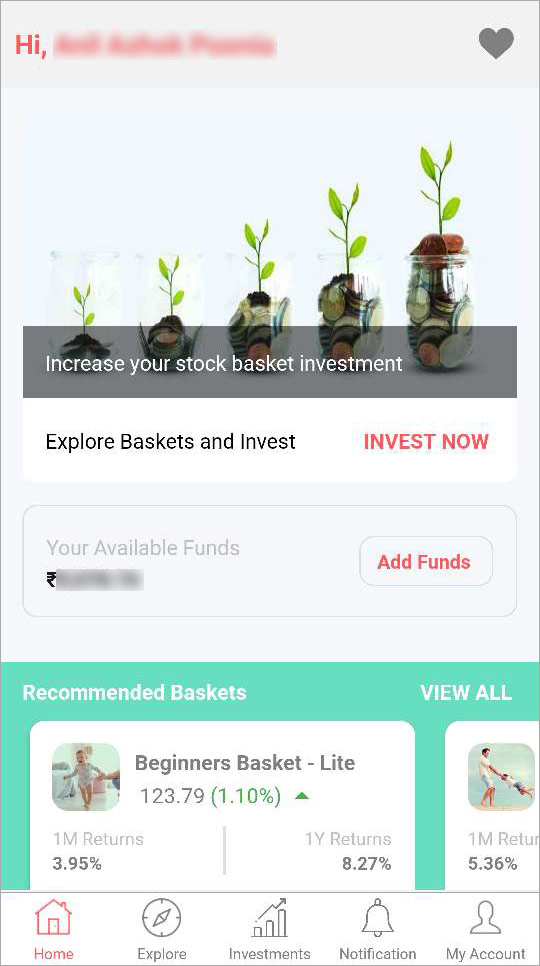

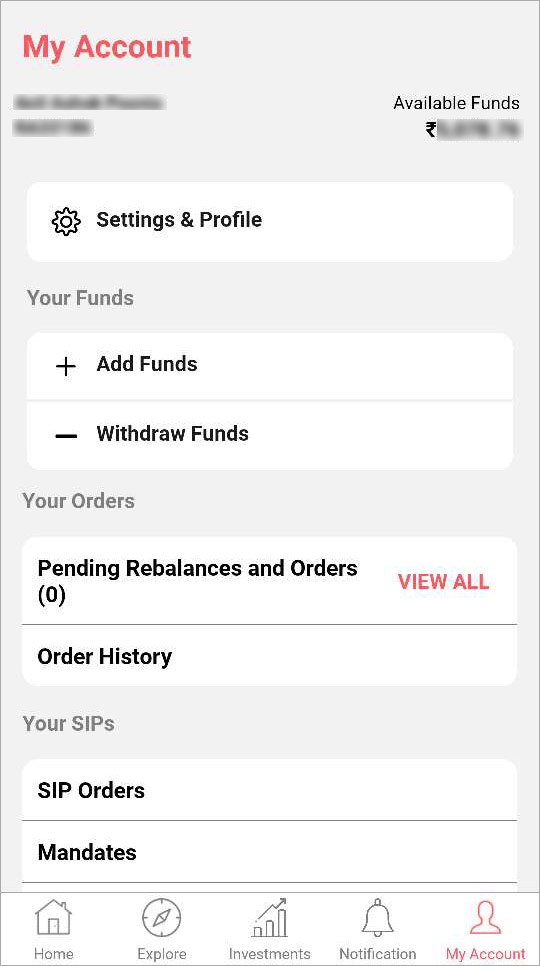

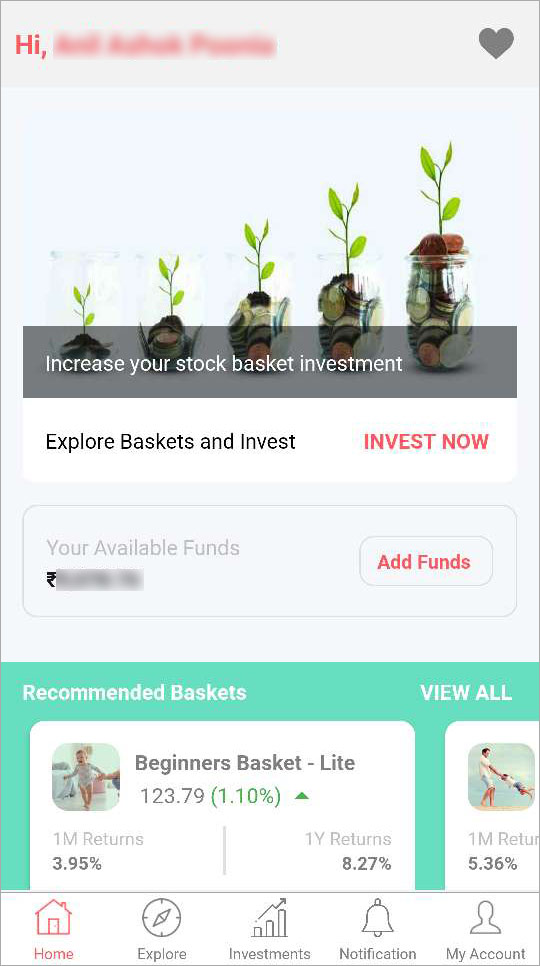

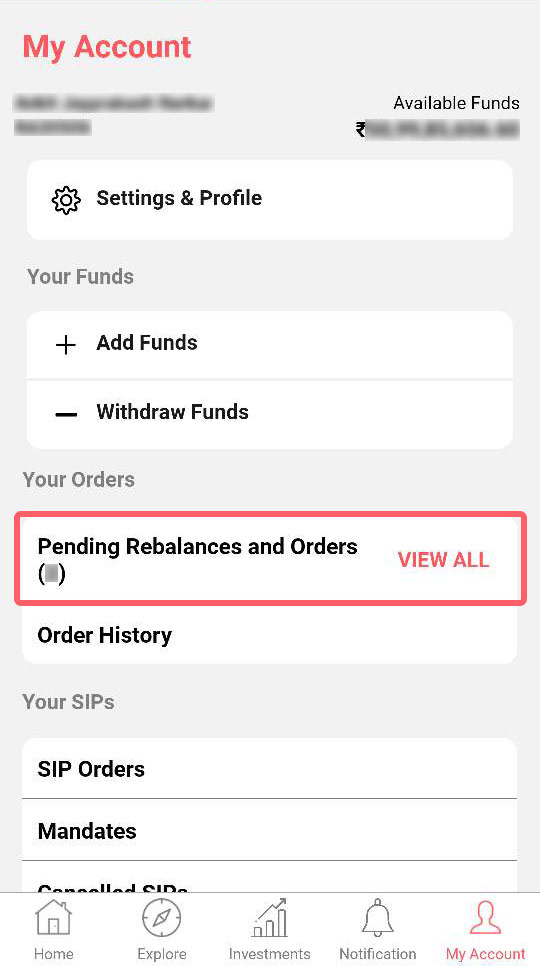

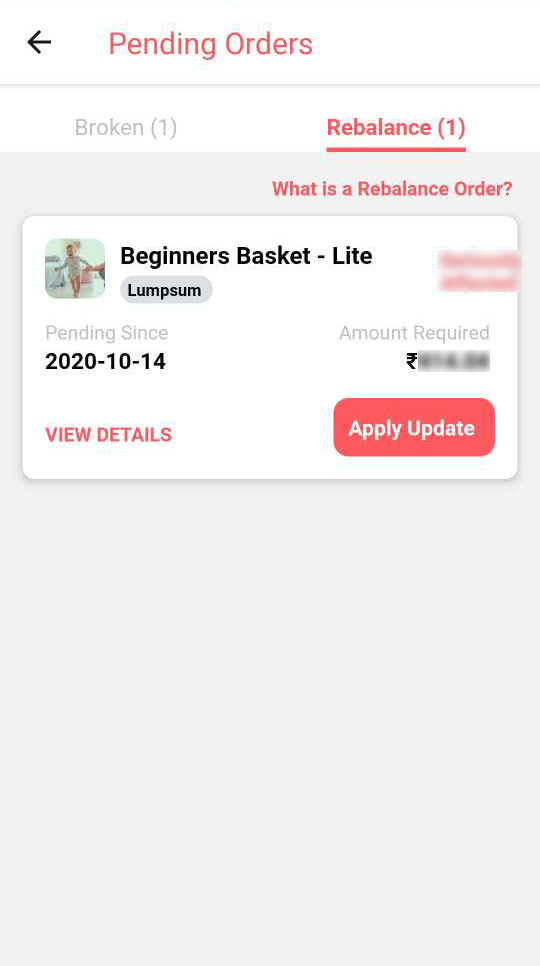

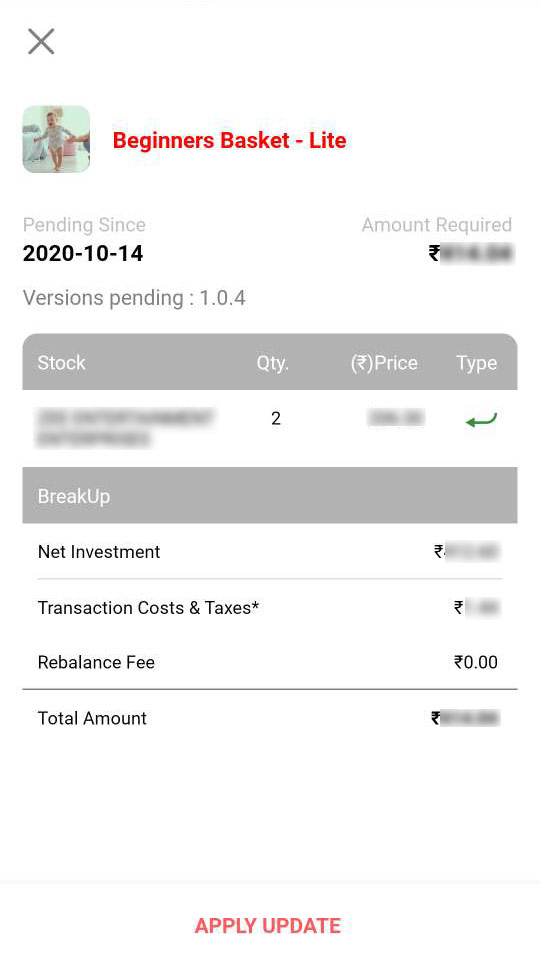

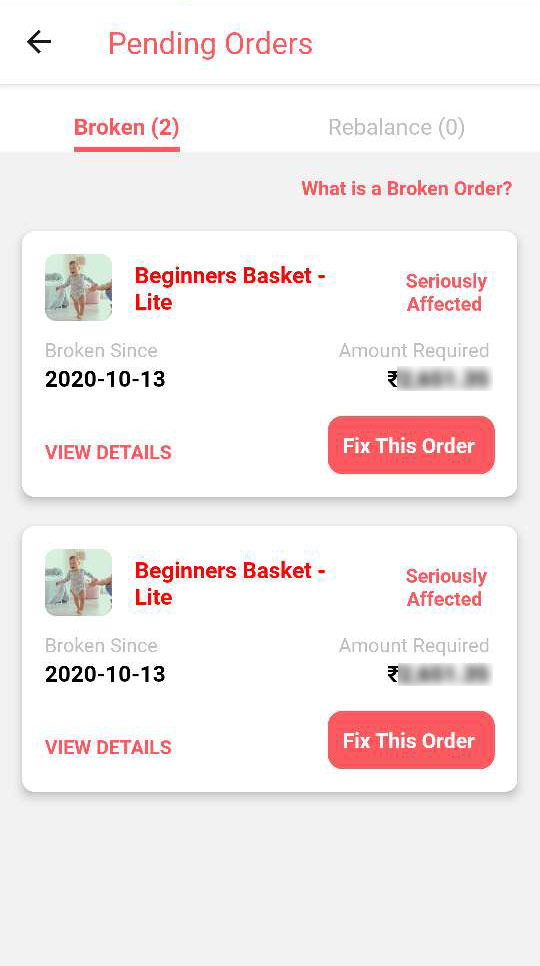

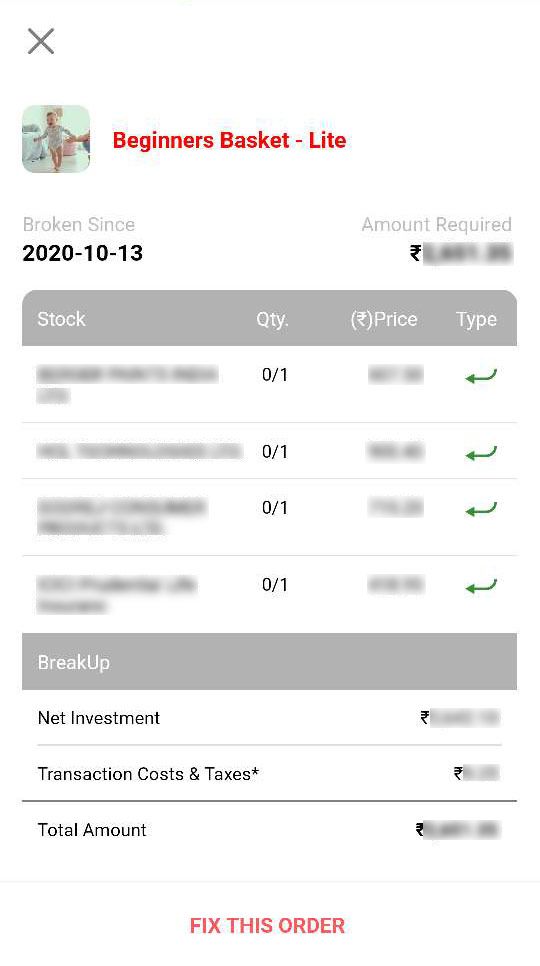

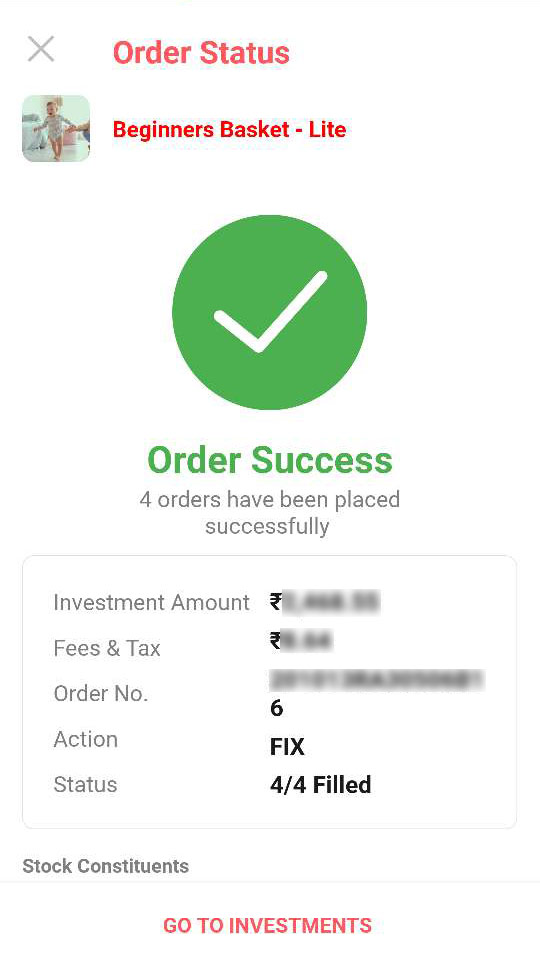

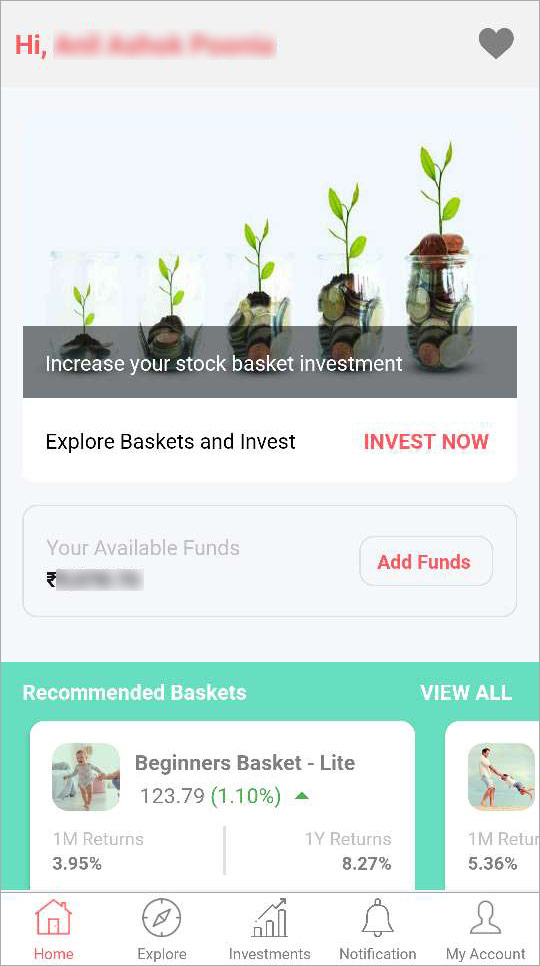

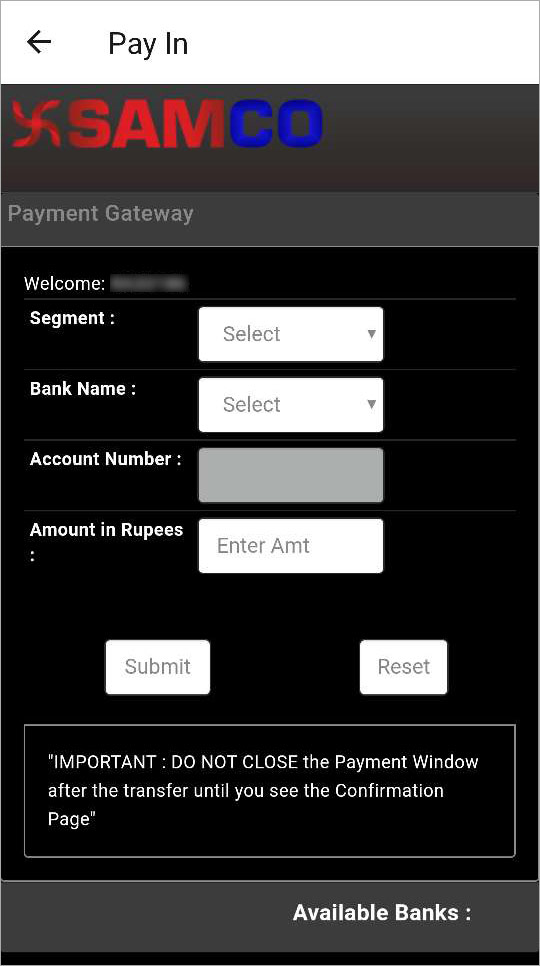

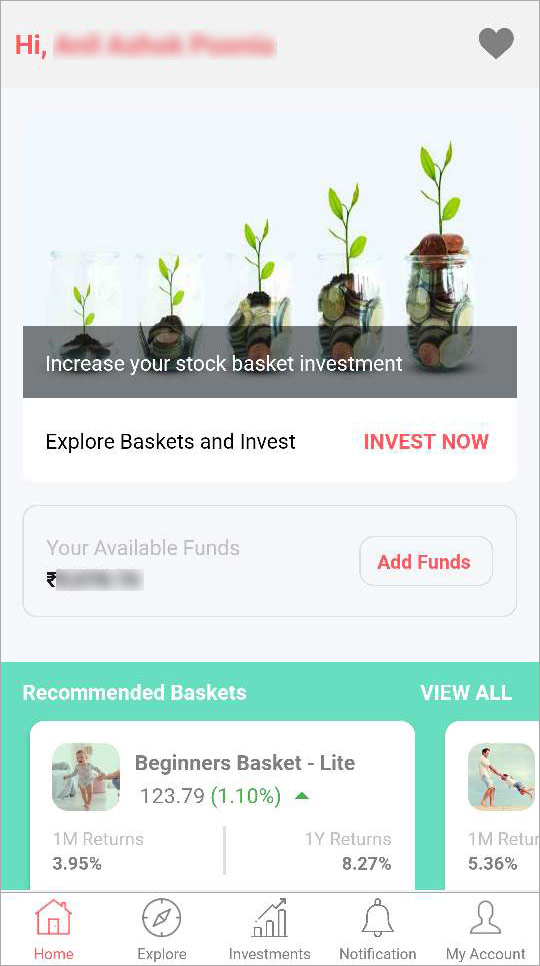

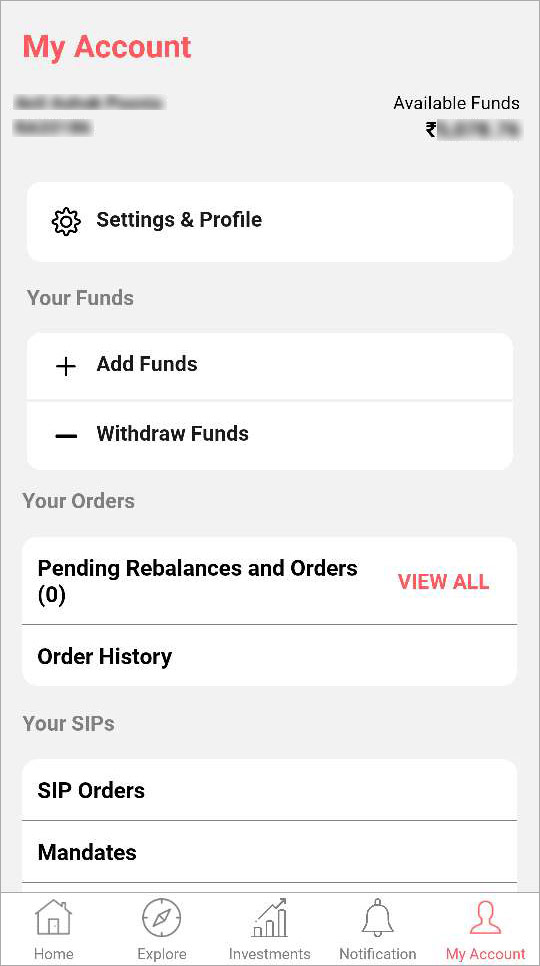

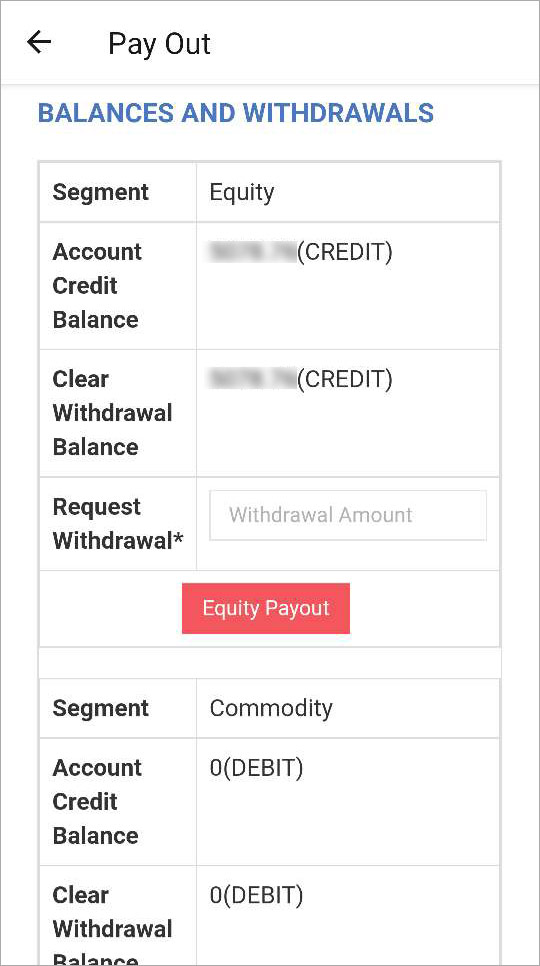

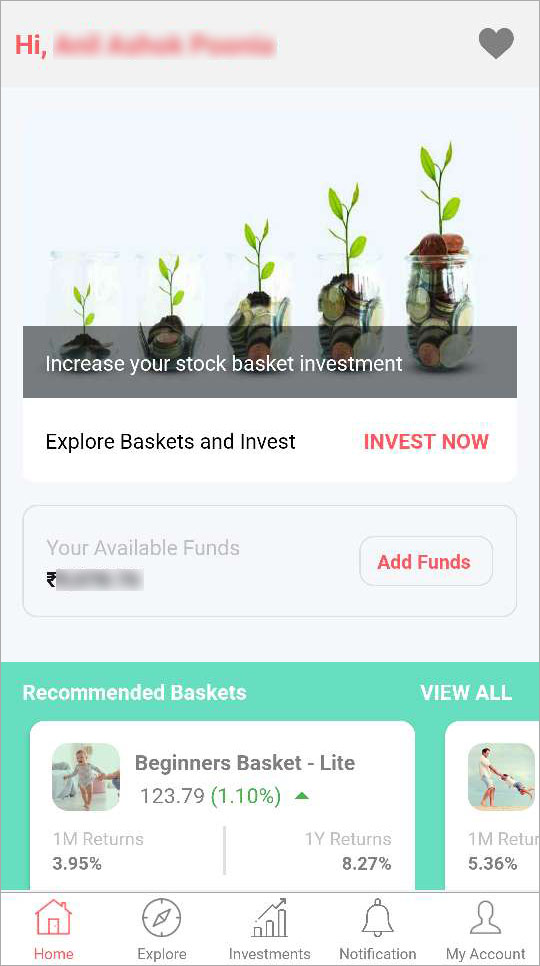

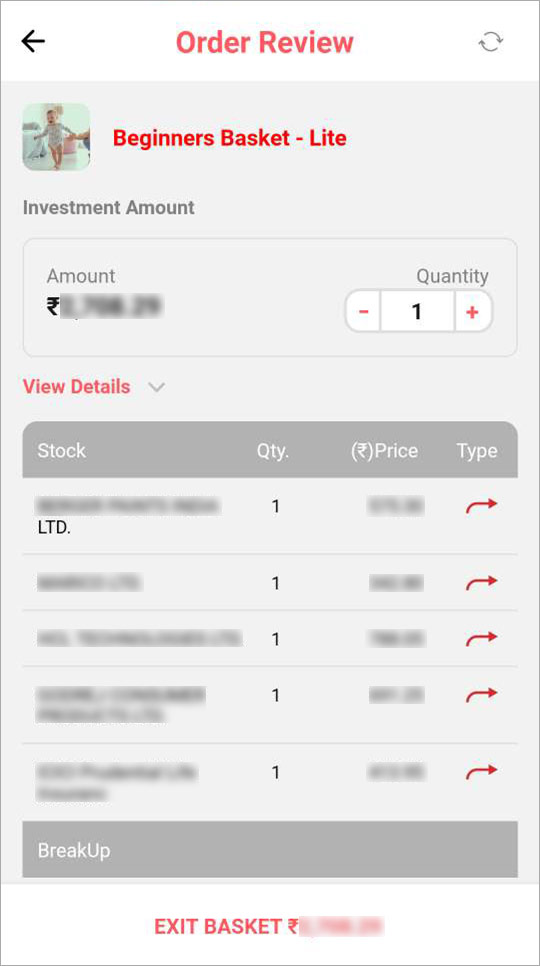

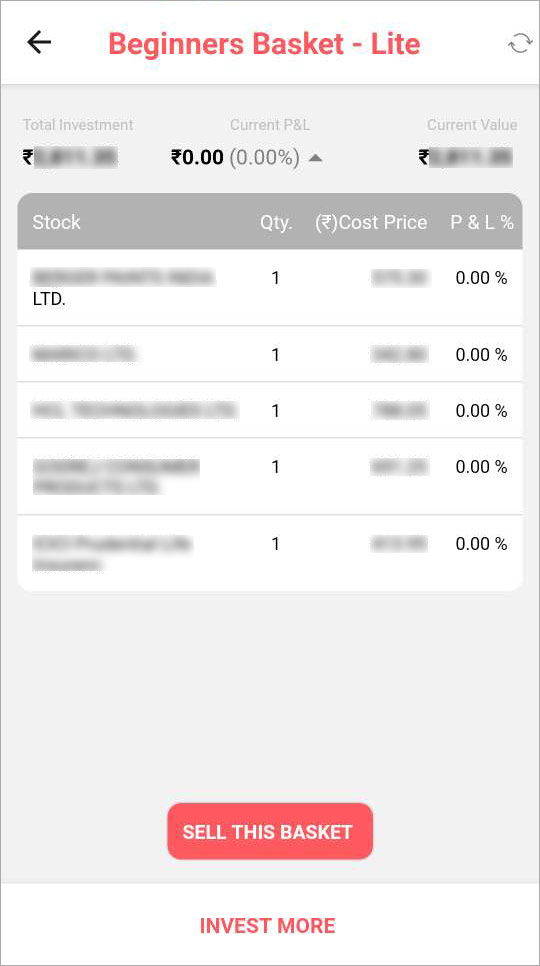

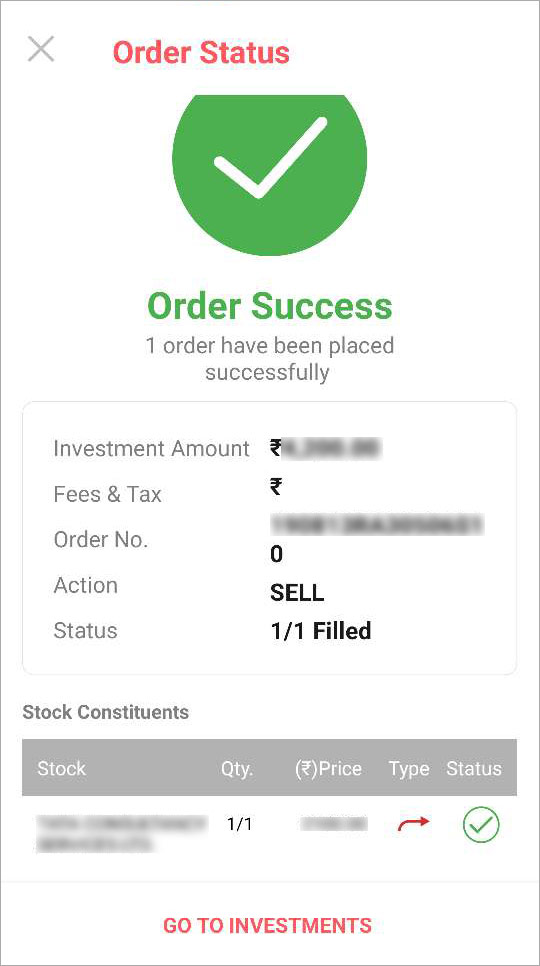

One such investment platform that follows similar way is StockBasket– India’s first long term buy and hold investment platform. These are expert-curated ready-made baskets of stocks. All you need to do is to invest your hard-earned money & persevere the ever-changing market trends in long-term investment & trust in the process of StockBasket for your financial gains! StockBasket always urges its investors to stay invested for a minimum period of 5 years (Max – Forever) so that they can get the benefit of compounding and grow their wealth in the long term.