Process of wealth creation starts with setting financial goals. Financial goals are your targets for a specific financial need. Some examples of financial goals are buying a house, buying a car, a child’s education or holidaying in your fav destination. Financial goals are different for everyone depending on their needs and priority.

Long term wealth creation requires proper planning and discipline in investing. Planning your expenses and investments are a must for wealth creation. Once you set your financial goals, you can start planning and investing your money to achieve these financial goals.

Choosing the right investment instruments is the second step towards achieving financial goals and long term wealth creation.

Tips for long term wealth creation

-

Write down your financial goals: Financial goal setting is an important exercise to start for long term wealth creation. these goals are your actual wealth creation plan

We have laid simple rules to create your financial goals, rather than complicating it. Your financial goals should be SMART.

S - Specific - Financial goals have to be very very specific, List down everything you need and try and make them specific. Eg. I want a car is not a specific goal but I want a Hyundai Creta is a more specific goal. You would know how much a Hyundai Creta cost so you will be able to plan accurately for this

M - Measurable - Now let’s assume you know which car you want to buy but don’t know how much it cost, how much you will start saving? or how much money you need to buy this car?. Goals have to be measurable like I want to buy a Hyundai Creta that costs 16 lacs.

A - Achievable - Once your goals are specific and measurable just read them to your self loudly twice to make sure they are achievable, Your goal cannot be something that is not achievable like I want to own 10 Rolls RoyceCars. Goals have to proportionate to your income and should keep evolving as your income grows each year.

R - Realistic - Unrealistic goals will take unrealistic time and money before they are accomplished and will only create unnecessary stress, so your financial goals for wealth creation should be realistic, your goal cannot be owing 1 car of each brand available on earth.

T - Time-bound - I am sure every one of you understands that targets should always be time-bound, now in the above example if your goal is to purchase a Hyundai Creta for yourself which is worth 16 lacs but when ? in 100 years or tomorrow?. All goals should be extremely time-bound and they should be given a reasonable time to achieve. “I want to buy a Ferrari in two days is not a practical goal, unless you already have all the money to buy it.

Now let’s take a few examples of a good goal and a bad goal.

Good Goal: I want to buy a house in Mumbai in 10 years, the price of this house is 100 lacs and I need 40 lacs as a downpayment

Bad Goal: I want to buy a Villa of 50 crores in 1 month.

Good Goal: I need 25 lac rupees in 5 years for my daughter’s education

Bad goal: I want money for my daughter’s education.

-

Start early

The power of compounding kicks in when you start early. Even if you start small it has the potential to create a huge corpus for you. Additionally It also inculcates a habit of investing regularly. The ideal time to start Investing is from the day you receive your first paycheck.

Starting early gives investors enough time to stick to your wealth creation plan and grow your money. Youngsters often have high disposable income before getting married, this is the perfect time to invest in equity, mutual funds etc to create wealth in the long term.

-

Balanced asset allocation

Once you have your financial goals in place and you have to start investing, choosing the perfect blend of investment is a must. Investing more or less in one asset class can actually create liquidity problems.

Rule of thumb sales that you should divide your investments in Equity and Debt instruments based on your age. For Example if you have Rs 100 to invest and your age is 30 then you should invest 30% of your Rs 100 in Debt instruments and 70% of your money in Equity instruments.

Systematic investment in good quality expert-selected stocks can be a great choice to create wealth in the long term. This habit also enables creating a rock-solid portfolio in a few years, Remember good things take time to grow.

Check out StockBasket to invest in a great mini portfolio or basket of stocks to create long term wealth.

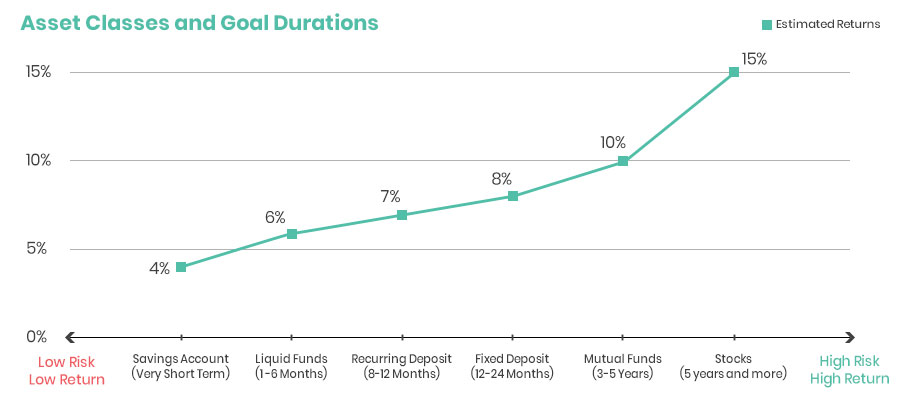

Asset classes also have to be selected based on the time frame of your financial goals.

Some of the most common asset classes available are:

- Fixed Deposit

- Gold

- Real Estate

- Mutual Funds

- Stocks

- Bonds

The following chart gives a reference of asset classes, returns and suitable goal duration

*Asset classes and returns are general estimates, Actual rates may differ, this is no way a recommendation to invest in a particular asset class

Asset Class Suitable for Duration Estimated Returns Savings Accounts Ultra Short Term 3-4% Liquid Funds 1-6 Months 5-6% Recurring Deposit 6-12 Months 6-8% Fixed Deposit 12-24 Months 6-9% Bonds and Debt Instruments 12-24 Months 8-9% Mutual Funds 36 Months and Above 10-15% Stocks 60 Months and Above 15% and more *Asset classes and returns are general estimates, Actual rates may differ, this is no way a recommendation to invest in a particular asset class

-

Invest regularly

Equity markets, SIP in a basket of good stocks can be a great wealth creator and compounder, chart of SIP returns V/s FD and other asset classes

With all of the above tips, one key aspect is to invest regularly, no matter the amount or investment size but it’s necessary to invest regularly. SIP is a very famous way of investing regularly and maintaining discipline in investing.

One can start SIPs in mutual funds and mini portfolios of expert-selected blue-chip stocks for long term wealth creation. SIP in StockBasket is a very suitable investment instrument for a long term wealth creation plan and all your long term wealth creation plan must have a SIP in StockBasket.

-

Keep and save an emergency fund

Emergency funds are the cash savings that you might need in any crisis situation, an Ideal amount is 6 months of your monthly expenses should be lying in liquid funds or savings account. While planning for long term wealth creation you should never touch your emergency funds and this amount should always be available to you whenever you require.

Basic Investment Plan for Long Term Wealth creation

Lets now understand and look at a basic plan for long term wealth creation. Below is a simple chart that once can follow for creating an investment plan based on goals

It is advisable to have adequate life and medical insurance coverages before you starting investing in other financial goals.

| Goals | Remarks | Suitable Asset Class |

|---|---|---|

| Emergency funds | Emergency Funds Amount = Your over all monthly expenses including household expenses, leisure, EMIs etc X 6 months | Fixed Deposit, Liquid Funds |

| Buying house | You can target planning a down payment or full house amount, generally this goals should be very long duration | SIP in Mutual Fund + SIP in Blue chip Stocks |

| Child’s education | SIP in Mutual Fund + SIP in Blue chip Stocks | |

| Retirement corpus | SIP in Blue chip Stocks | |

| Buying a car | Fixed Deposit + Recurring deposit |

Investment options for wealth creation

There are a lot of investment instruments available however long term wealth can be only created when you save a huge corpus for your financial goals while generating good returns and beating inflation simultaneously. SIPs in mutual funds and a mini portfolio of expert-selected stocks on StockBasket. Check out the asset class comparison chart based on their returns.

Dos and Don’ts while investing for long term wealth creation

Dos

- Invest regularly

- Start early

- Divide your money among asset classes

- Have SMART financial goals

- Invest only in good blue-chip stocks for wealth creation

Don’ts

- Do not keep all your money in bank account

- Do not over invest in 1 asset class

- Don’t stay away from investing because you do not understand it, take help from an expert.

- Don’t Ignore medical and life insurance