Before deep-diving into the concept of value investing let us first discuss the types of investments

“Price is what you pay. Value is what you get.”

– Warren Buffett

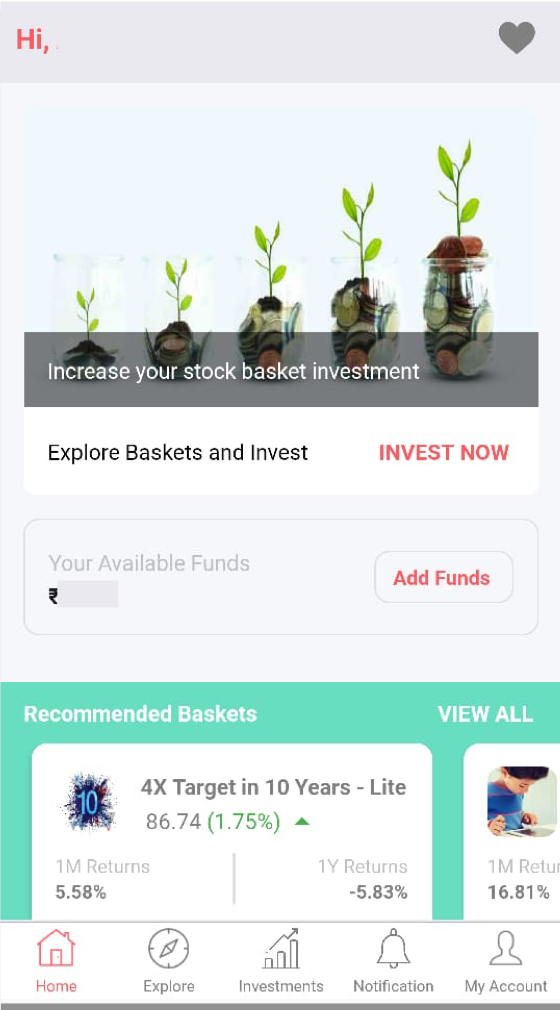

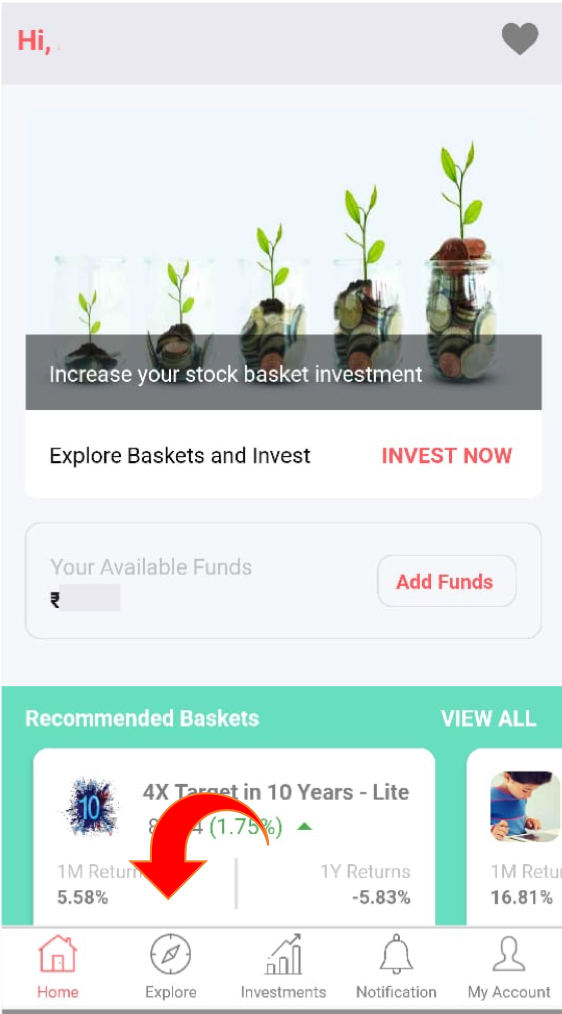

Investing is a very dicey process especially in today’s world where lots of information keeps flowing around; be it online, on television, newspapers, or any other media source. The primary objective of investing is capital creation by increasing income-generating assets.

Stock market comes to our mind when we think about investing in risky assets. The stock market has fascinated everyone, but not everyone has been able to make money out of it.

Investors in the Stock Market can be done two types: Trading or Investing

Time and again it has always proved that it is the investors who make money and not the traders in the long-term. The logic is simple, to be successful in trading your decisions are bound to be a correct day in and day out or more frequently which is highly unlikely as the market is not structured in such a manner. The odds are stacked in favour of the market and not in favour of the trader. Investing on other hand has a greater chance of giving good returns as the number of decisions to be taken are less, and investor has to identify superior quality stocks and stay invested in them for a long term to generate great returns, with the magic of compounding coming into play.

What is Value Investing?

Investopedia defines value investing as “The strategy of selecting stocks that trade for less than their intrinsic values”.

Value investing can be explained in simple terms as paying less than the fair value of a stock to earn good returns when the stocks get back to its normal or fair value. This concept was introduced by The Father of Value Investing – Benjamin Graham. It involves finding those stocks or companies that are believed to be undervalued or are available at a discounted rate, on the basis of the various financial parameter.

This style of investing is closely related to the concept of margin of safety. It can be defined as the difference between the intrinsic value of a stock and its market price. or in simple words the difference between the discounted rate and the actual market value or fair value. It protects the investor from errors involved in the judgment of fair value, it also provides good-return opportunity and minimises the risk Value investing can provide good profits once the market inevitably re-evaluates the stock and raises its price to fair value over the long term.

Watch our video to learn about value investing

There are various financial ratios and factors by which and investors can decide the value of the stocks they are:

- Return on Equity (ROE)

- Return on Assets (ROA0

- Operating Profit Margin (OPM)

- Debt to Equity Ratio (D/E)

- Promotors holdings etc.

Some other characteristics that the investors should also look out for are the history of the company, promoters history, its market share, business model etc.

Why Value Investing?

There have been numerous examples of investors like Warren Buffett, who have made immense wealth by adopting this style of investing, one can create a huge wealth in the long term by adopting this technique.