Do you know the infinite wealth secrets of Warren Buffett, Peter Lynch, Rakesh Jhunjhunwala and Mohnish Pabrai?

It is nothing but - ‘Long Term Investing’.

Yes, all these investing legends have created their fortunes through a simple yet disciplined and profitable investment approach of Long term investing.

Now we know that you are here for the names of best share to buy for long term. We have revealed it all in this article. However, don’t leave after getting the list of best long term stocks.

We are certain that if you read the whole article you will get much more than best long term stocks.

You will get a complete system and a process with which you can confidently invest for the long term.

So let us begin…

What are the two biggest secrets behind success of great investors we spoke about earlier?

First is to buy good quality stocks.

Several investors fail in the first step of long term wealth creation - stock selection. They invest in poor quality stocks with limited chances of making money. Do you know that nearly 95% of stocks do not consistently make money for investors over the long term?

Most investors don’t know how to pick the right stocks falling in the remaining 5% basket. Don’t worry we will tell you about them today.

We have revealed the list of long term investment stocks for 2021 below. Before you rush to buy these stocks. please understand that getting a list of best long term stocks to buy isn’t an end in itself. There is one more thing you must know about if you want to become a better long term investor. So please read the full article.

List of the 10 Best Stocks to Buy in India for Long Term 2021

| Stock | Returns* in % | Market Capitalisation (in Cr.) |

|---|---|---|

| Bajaj Finance ltd. | 141.23 | 3,01,224 |

| Coforge ltd. | 93.18 | 17,067 |

| Infosys ltd. | 89.43 | 5,86,204 |

| Jubilant Foodworks ltd. | 83.80 | 38,620 |

| Tata Consultancy Services ltd. | 59.32 | 1,191,926 |

| HDFC Bank ltd. | 49.65 | 7,99,408 |

| Godrej Consumer Products ltd. | 44.59 | 78,690 |

| Crisil ltd. | 34.49 | 14,155 |

| ITC ltd. | 23.73 | 2,49,178 |

| Hindustan Unilever Ltd. | 17.84 | 5,70,730 |

* Returns after our recommendation on 6th May 2020 to 7th Jan 2021

Thank you for staying on with us. We are confident that you will get the full value of time you spend on reading the remaining part of the article.

When you are investing for the long term, it is of utmost importance to invest in the right stocks and not duds. You want to invest in Reliance Industries and not Reliance Communications. Right.

But how do you know whether the stock you are buying is the right one?

You must develop your own process that you can follow with conviction. But how do you develop such a process?

Simple. You must learn from other long term investors who are successful. Now you may not be able to access such long term investors directly that’s why we at Samco Securities have decided to help you.

Every Saturday we bring to you actionable insights from people who are successful in markets.

Here’s an episode where we invited Mr. Khushal Jhaveri who is a long term investor by passion. His long term investments in companies like Honeywell Automations, Hindustan Unilever and Titan has generated returns like 5,767%, 11,233% and 37,400% respectively for him.

You can watch his episode and learn the process of picking stocks for the long term.

You can learn from this video. But like I said there’s one more step to successful long term investment apart from buying the right stock.

That is sticking with these stocks for really long time. So first you buy right and second you sit tight. Unfortunately, retail investors aren’t able to sit tight in a stock. There are a few reasons behind it.

Like we said earlier, they don’t know how to find the right stock. Even if they have bought the right stock they don’t have the skillset to analyse whether the company is staying on the right path.

For example a company’s stock price may be falling just because the entire market is in a downtrend. Even stock price of good companies with strong fundamentals will go down during such phases.

If you are a long term investor then you must learn to accept this. No company’s share price will always go up.

The company’s share price may be falling because of deteriorating fundamentals. How do you differentiate between the two. It may be easy for veterans in the stock market but not for common retail investor.

Apart from this there could be a corporate governance issue as well. How does the retail investor with limited time and resource judge these things?

It is nearly impossible. That’s why we at Samco Securities decided to come up with a solution especially for long term investors.

Samco has launched StockBasket which is India's first long term investing platform.

StockBasket uses a unique proprietary model that processes more than 20 million data points daily. It decides the quality of stocks based on more than 60 intelligent parameters and recommends best stocks for long term in each basket.

These baskets are group of stocks carefully curated by our Securities and Exchange Board of India (SEBI) registered research analysts. They use the power of our proprietary artificial intelligence (AI) technology.

The research team continuously monitors these baskets and modifies it when needed. Thus, helping retail investors stay with the right stock for the long term.

The stocks recommended in these baskets must pass the 5-year bond test. If the markets shut for 5 years from tomorrow then the investors should be able to sleep without any worries. Only if the stock pass this test it is picked for a basket. It helps us shortlist stocks that would survive as well grow with great certainty.

Thus, the only thing that investors must do is pick a basket of their choice. They can select these baskets based on their investment needs. These baskets are built on four major criteria.

1. Thematic

These baskets are curated based on long-term themes like growing consumption and rising rural demand.

Examples: Digital India Basket, Leaders of Tomorrow Basket, Dividend Champions Basket.

2. Goal-Based

These baskets are curated based on life goals like accumulating a major corpus for child's education or retirement planning.

Examples: Domestic Education Basket, International Education Basket, International Vacation Basket, Retire in 2040 - Lite Basket.

3. Risk-Based

These baskets are curated based on risk profile of the investor.

Examples: 5 Year - Low Risk - Lite Basket , 5 Year - High Risk - Lite Basket

4. Time-Horizon based

These baskets are curated based on duration of investment of 5 and 10 years.

Examples: 4X Target in 10 Years - Lite Basket, 4X Target in 10 Years Baslet

We are sure that you would be excited to invest in one of these baskets right away. But hold on to your excitement. There’s much more…

StockBasket is a unique long term investing platform which solves several problems of retail investors. We would like to offer this platform for free. But you know that developing and maintaining such platform incurs lot of cost.

We charge a miniscule fee per quarter for subscribing to a basket. This enables us to recover our costs and offer the best service to you. This fee is negligible compared to the management fee large mutual funds and portfolio managers charge you.

Another advantage of doing long term investing with StockBasket is that we charge a fixed fee instead of the percentage commissions charged by these mutual funds or portfolio managers.

This fixed fee ranges from Rs 12.50 to Rs 8,000 per quarter depending on the basket you chose. Most baskets are available under Rs 500 per quarter.

This helps you in saving costs as your portfolio grows over time. That’s not all. To show you how much confidence we have in StockBasket we are giving a 5-year money back guarantee.

We believe that... we shouldn’t make money, if you don’t. If you lose money in a particular basket even after holding it for a period of 5 years then the subscription fee collected over 5 years will be refunded to you.

This is a first in the industry. No other mutual fund or portfolio manager has given such guarantee that we know of till date.

We charge a nominal fee of Rs 79 if you exit any of the basket before 5 years. This fee is just to instill discipline to stick to your long term investments over anything else.

Now that we have taken care of the risks and costs…let’s talk about the potential rewards.

StockBasket was launched on 30 September 2019. It’s just less than two years. We know that it is too short a time to judge performance of a long term investing platform.

Nevertheless, the performance of StockBasket over such a short period is also stellar.

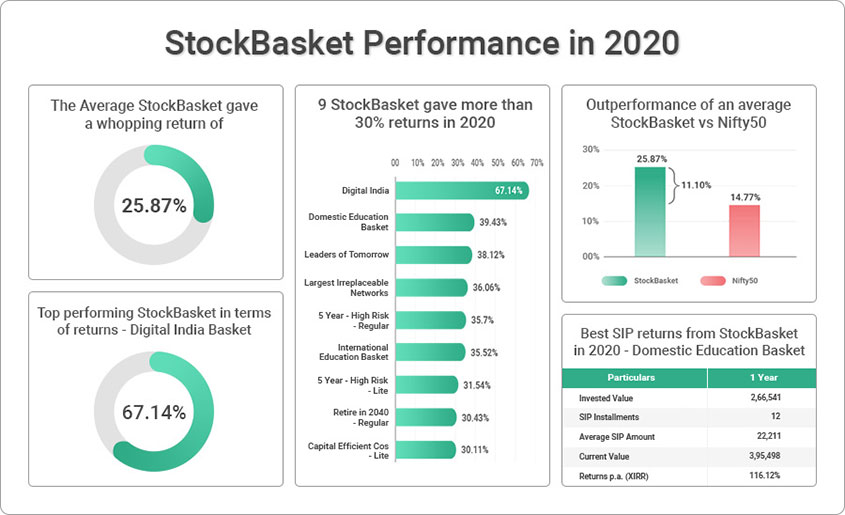

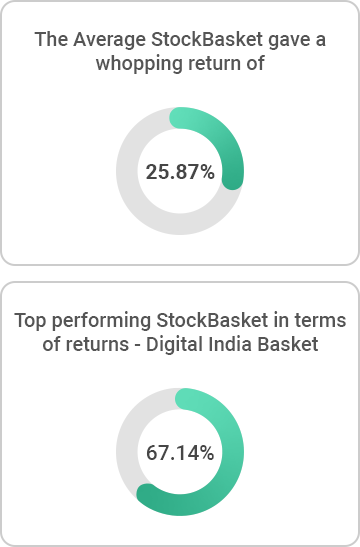

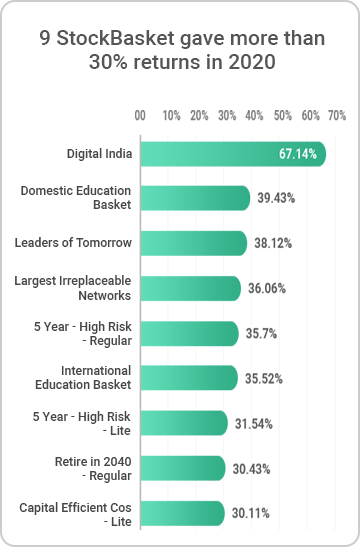

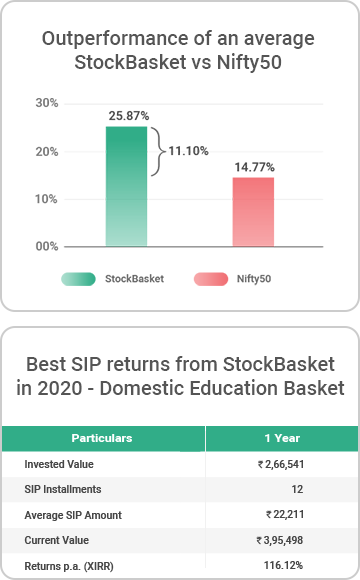

The average returns of all StockBaskets in the year 2020 was 25.87%. This was 11.10% better than performance of Nifty 50 index.

Digital India basket has nine stocks in its portfolio. It was the top performer with 67.14% returns.

Domestic Education basket provided the best SIP returns in 2020. Yes, you can even start a systematic investment plan for any basket of your choice.

Now we are sure that you are super excited to begin your long term investing journey with StockBasket.

Here’s what you must do next...

1. Open a free demat account with Samco Securities

You need a demat account to buy and hold shares for the long term. If you don’t have a demat account with Samco Securities then open it right away. It just takes 15-20 minutes to open a demat account. The best part of opening a demat account with Samco is that you get access to other unique and first in industry products like RankMF, StockNote and KyaTrade.

2. Download the StockBasket app and explore available StockBaskets

You must download the StockBasket app. Investing through StockBasket is available only through mobile app for now. So we recommend you to download the app right away and explore the baskets of your choice. You can pick any out of the 28 baskets available on the app. You can start with the Beginner’s basket if you are new to long term investing.

3. Invest in basket of your choice

You must transfer funds through NEFT or UPI to your Samco account. These funds are reflected on StockBasket and across other platforms within minutes of transfer. So no need to transfer funds individually. Just transfer it once on your Samco account and you are done. You can now invest in the basket of your choice and pat yourself on the back for a job well done.

4. Do nothing and watch your wealth grow stress free

Welcome to the world of stress free long term investing. You don’t have to do anything else now. Just sit back relax and enjoy the fruits of long term investing.