How does Blue Chip ever relate to the financial term ‘Stocks’?

Does reading the term ‘blue chip’ make you think of those flat, round blue chips with white patches, that you probably must have seen on a TV show? Then you sure are on the right track!

After you read this article you will know how important this term is in this economic-driven world & why it is specifically called Blue Chip Stock.

But before we go into the history of blue chip stocks, let me reveal the top 10 blue chip stocks in India.

| Blue Chip Companies |

Sector | Market Cap (in Cr Rs.) as on 20th Mar 2020 |

Rate as on 1st Feb 2005 |

Returns(%) in 15 years |

Rate as on 1st Feb 2020 |

|---|---|---|---|---|---|

| TCS Ltd. | IT | 674472.39 | 166.64 | 1291.62 | 2319 |

| HDFC BANK Ltd. | Banks | 481362.94 | 58.6 | 2015.69 | 1239.8 |

| HIND UNI Ltd. | FMCG | 444,329.52 | 144.05 | 1396.98 | 2156.4 |

| MARUTI SUZUKI INDIA Ltd. | Manufacture | 153,369.07 | 473.1 | 1421.79 | 7199.6 |

| INFOSYS Ltd. | IT | 247,116.71 | 138.91 | 461.15 | 779.5 |

| KOTAK MAH.BK Ltd. | Banks | 241,764.45 | 32.91 | 4993.43 | 1676.25 |

| BAJFINANCE Ltd. | NBFC | 178,262.42 | 14 | 33231.07 | 4666.35 |

| ITC Ltd. | FMCG | 215,790.12 | 28.6 | 665.73 | 219 |

| ASIAN PAINTS Ltd. | FMCG | 167,461.55 | 35.55 | 4837.69 | 1755.35 |

| HCL TECHNO Ltd. | IT | 120,880.21 | 42 | 1327.86 | 599.7 |

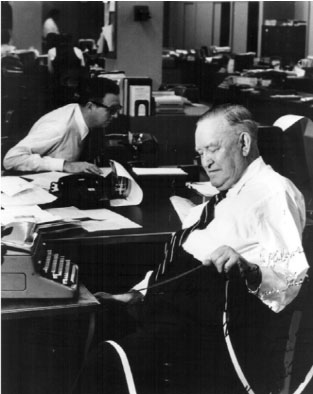

The story behind the term “Blue Chip Stocks”

Source: http://www.philadelphia.edu.jo

This famous term echoing through Wall Street even today comes from an employee named “Oliver Gingold” of a famous company “Dow Jones”.

The term got a push in around 1923 or 1924. Gingold noticed that many shares were trading at $200 to $250 or more as he was standing by the stock ticker of a brokerage firm.

He returned to his office after noticing these high trading prices to write about “Blue chip stocks”. He related all the high priced stocks with the blue chips which have the highest value in the Game of Poker.

Originally, this connotation was only related to high priced stocks but then later as time passed by, this term was broadly defined as High Quality Stocks.

What are Blue Chip Stocks?

Many blogs or articles on blue chip stocks will start off explaining it with complex financial terms that will make it extremely difficult for you to understand. Let’s make it a cakewalk for you. Consider this example:

There’s a student who consistently scores excellent marks in Math & always stands first among other students in the class. His classmates always rush to him when there’s a Math question, or refer his notes for a better understanding of the subject.

But to maintain his rank, he needs to be consistently on the top.

In the above scenario,

Boy - Blue Chip Stock

Math - Sector

The boy becomes a benchmark for all his classmates as they try to follow his strategy.

On similar lines, blue chip companies are financially sound companies with a long, stable track record. They are Market Leaders in their sector and have huge market capitalization. Blue chip companies are the poster boy of the stock market and are part of all major stock market indices. Coca cola, Alphabet, Amazon are examples of global blue chip stocks.In India, Reliance Industries, TCS, Infosys, HDFC etc are top blue chip stocks.

How to identify blue chip stocks?

Here are 10 characteristics of blue chip stocks that can help you identify these market leaders:

- Large Market Cap

- Consistent Earnings Growth

- High Dividend Payouts

- Low Debt to Equity Ratio

- Strong Financials (P/E, PEG and P/B, High ROCE and ROE).

- Strong Balance Sheet

- Stable Cash Flow

- Low Volatility

- Brand Credibility

- Good Weightage in Index

Of these 10 characteristics, the 3 most important parameters to identify blue chip stocks are:

-

Dividend Payouts: A dividend is a distribution of reward made by the company to its shareholders. If a company earns more profits then why does it roll out the profits in the form of dividends & not use it? Let’s make it easy for you to understand by a suitable example with 2 cases

In case 1, suppose you’re playing a game with 2000 in your hand. You are given two options door 1 and door 2 wherein you get to choose the door of your choice. There you find 3 treasure boxes & get to know that some contain treasure while some are empty. You open one treasure box and find it empty. You feel a little dejected but hope to find treasure in the 2nd box. You open the 2nd box and find it empty as well. Now you feel a lot dejected & try to be content with the 2000 you received in the first place. Now you open third and find 2000! You are rejoiced and overcome the dejection you’ve been feeling. Now you have a total of 4000.

In case 2, you have the same conditions and you choose the same door to find the same treasure boxes. But now you open the first box and find 700 in it. You feel happy and you open the second one to find another 500 to pocket in! Now you open the last one and find 800 to give you the last push towards the edge of the cliff of happiness for winning a grand total of 4000 ( 2000 in hand and another 2000 by adding all the prizes won in the treasure boxes)

In both the cases, you’ve won the same amount so what’s the deal? In case 1 you feel dejected and start doubting your choice. Some may even quit playing in such dismal conditions. Whereas in case 2 even though you win small prizes consecutively, you feel happy and this gives a boost to your confidence for you to continue this game further.

The same mindset goes for dividend payouts, it is to boost your confidence in the organization which you are investing in so that you keep on investing with the company & maintain your loyalty with them. Besides, dividend payouts benefit the organization as well along with the investors. It helps in reducing the volatility of the stock, increase their share prices & hence increase their net worth, etc.

The top-notched companies often pay dividends with increasing dividend prices.

-

Price-to-Earning Ratio (P/E): It is the ratio of a company’s share price to the company’s earning per share. P/E ratio helps investors understand whether a stock is fairly priced, underpriced or overpriced.

P/E Ratio = Share Price / EPS

Where:

Earnings per share (EPS) = Net profits / total number of outstanding shares.

Let’s calculate the P/E ratio for ABC Ltd. On 31st December 2020, the share price of ABC Ltd was 2,000. Its net profit for the December 2020 quarter was 6 Crores and number of outstanding shares were 10 Lakhs.

The EPS of ABC Ltd = 6 Crores / 10 Lakhs = 60

The P/E ratio for ABC Ltd = 2000 / 60 = 33.33

- A high P/E ratio means the share is overpriced and investors should exercise caution before investing.

- A low P/E ratio means the share is undervalued and it is a good opportunity for investors to invest, provided the stock is fundamentally sound.

-

Price-to-Book Value (P/BV): It is the ratio of share price to the book value. Book Value is calculated by dividing the company’s net assets by the total number of shares.

Book Value=Shareholder's Equity - Preferred Equity

Total Outstanding Common Share'sFrom this, we get: (Price-to-Book Value formula)

Price to Book Value=Market Price Per Share

Book Value Per ShareConsider an example. X company has net assets of 2,40,000 and has issued 6000 shares of 20 each. Its book value will be 40 per share ( 2,40,000 divided by 6000 shares). Its price-to-book value will be 0.5 ( 20 divided by 40)

The lower the number or closer to 1, the more reasonable the price of the share.

Are Blue Chip Companies safe?

Considering Blue Chip companies are market leaders and excel at parameters such as a strong balance sheet, minimal debt, consistent earnings, high dividend yields etc, it is a given that blue chip companies are the safest stocks to buy.

Why Should You Invest in Blue Chip Stocks?

-

Superior returns: Since blue chip stocks are market leaders, they have high growth prospects and hence can deliver superior returns.

-

Low Volatility: Blue Chip stocks belong to financially sound and stable companies with competent management & corporate governance. This makes them stable and less volatile.

-

Passive Income through Dividends: Blue Chip stocks have huge cash surplus and therefore provide regular dividends to the investors.

How to invest in top blue chip stocks?

So, now that you have the list of the best blue chip stocks in India, the critical question is, ‘which blue chip stock will you invest in?’.

While blue chip stocks belong to fundamentally sound companies, you need to ensure that you diversify your investments to avoid putting all your eggs in one basket.

To help you diversify your portfolio, StockBasket has expert-curated baskets of stocks or mini portfolios that can help you to invest in top blue chip companies in the right weightage. The average StockBasket generated a 25.87% return in 2020, an outperformance of 11.10% in comparison to Nifty50.

Our ‘Leaders of Tomorrow’ basket contains top blue chip stocks in India which generated a whopping return of 38.12% in 2020.