Financial goals are the epicentre of our existence. We all have them. We all want to achieve them. Yet the majority of us end up failing to achieve our financial goals. The reason being lack of planning. This is exactly what we want to set right with this article. In this article we will discuss the 8 most important financial goals that you must have for a happier life. Let us begin by understanding what is a goal and what is a financial goal.

What is a Goal?

A Goal is any objective or desire that you want to achieve. It is different from a wish as a goal comes with a deadline.

All these are examples of a goal. But these are not financial goals. Because these goals do not have a monetary (financial) aspect.

What is a Financial Goal? – Definition of a Financial Goal

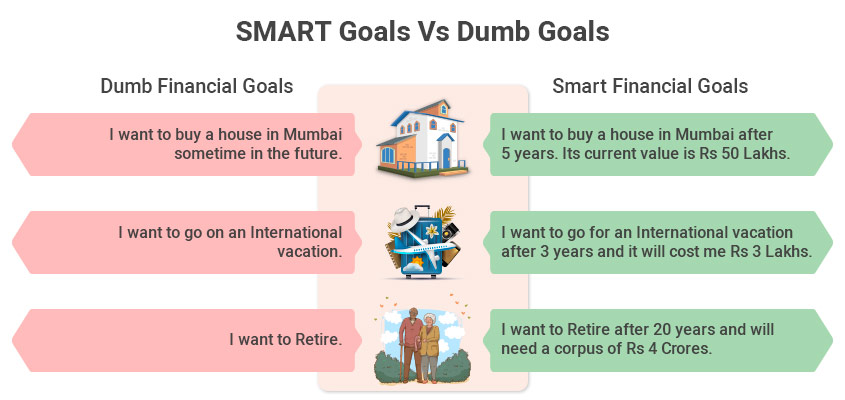

Financial goals are financial targets that you wish to achieve during a set period of time. As per a study, people who set well-defined financial goals are ten times more likely to achieve them. Also, when you set financial goals you are motivated and a savings habit develops. Setting clear financial goals is the first step towards successfully achieving them.

An important thing to remember while setting financial goals is the concept of SMART financial goals. The acronym SMART stands for Specific, Measurable, Attainable, Realistic and Time-Bound.

Common examples of financial goals include:

- Buying a car/bike

- Buying a house

- Saving for vacations

- Planning for children’s education and marriage

- Planning for retirement

Types of Financial Goals

Based on time horizon, financial goals can be classified into three categories:

| Financial Goals | Time Horizon |

| Short term financial goals | 1-3 years |

| Medium term financial goals | 3-5 years |

| Long term financial goals | 5+ years |

Based on how quickly you want to achieve them, your financial goals can be classified as:

- High priority goals

- Medium priority goals

- Low priority goals

Investors should align their assets and cash flow to high priority goals first and then move onto medium and low priority goals.

Let us now look at examples of 8 most important financial goals that you must achieve in 2021.

Examples of Financial Goals – 8 Most Important Financial Goals for 2021

Creating a Contingency Fund – Contingency or emergency fund is a unique type of financial goal. It is a life-long financial goal which needs to be replenished every time you use it. The aim of a contingency fund is to ensure you do not break your long term investments in case of emergencies.

Creating a contingency fund is not an ‘investment’. Hence you should avoid risky asset classes like shares or equity mutual funds. Instead you should invest equally in liquid funds and bank FDs. Bank FDs will give you instant redemption whereas liquid funds are redeemable after 1 day.

How to Create a Contingency Fund

- Ideally you should maintain 12 – 15 months of mandatory expenses as a contingency fund. Mandatory expenses does not include lifestyle expenses like movies, shopping, gaming etc.

- One you decide your contingency expenses, the next thing to do is multiply this amount by 12. So, if your mandatory expenses are 20,000 per month then you should create a contingency fund between 2,40,000 – 3,00,000.

- Invest 50% i.e. 1,20,000 – 1,50,000 in Bank FDs and the other half in liquid funds.

Paying off your Debt: Paying off credit card debt or personal debt is a common financial goal. While taking on debt, you should ensure that the overall EMIs do not cross 30% of your take home income.

While paying off debts, always start by paying off high interest debt first. You can also use the snowball effect to pay off your debt. In the snowball effect, you start by paying low interest rate debts first. Once loan repayment habit kicks in, you can tackle high interest rate debts.

-

Buying a House: Buying a house is one of the most common high priority financial goals in India. Since it is a big ticket financial goal, it requires a majority of your savings. Hence the best way to plan for such big ticket financial goals is to start early.

For example: If you want to buy a house worth 50 Lakhs today after 10 years. Then you will need to plan for a down payment of 10 Lakhs.

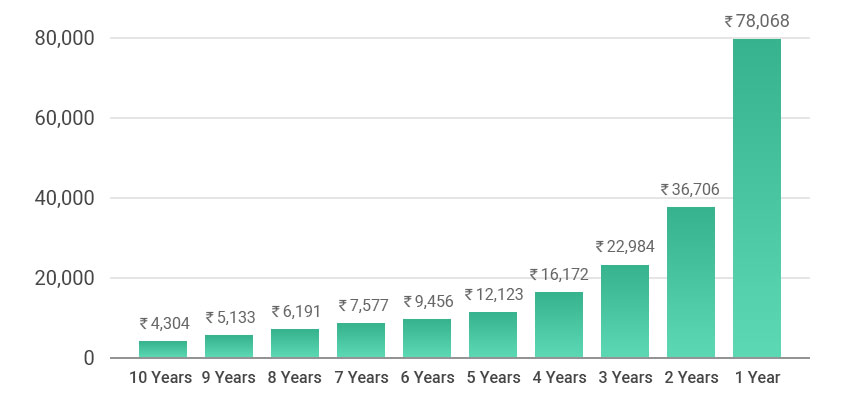

If you start saving with 10 years to the goal, then you only have to save 4,304. But if you don’t start saving for down payment till 5th year, then you will have to increase your SIP amount 120% to 9,456.

Child Education: Every parent wishes an Ivy League education for their children. But the majority of parents struggle achieving this despite having decent incomes. The reason for failure in securing your child’s education is lack of planning. Parents wait till the child is 10 years old to plan for graduation. This gives them only 8 years’ time frame.

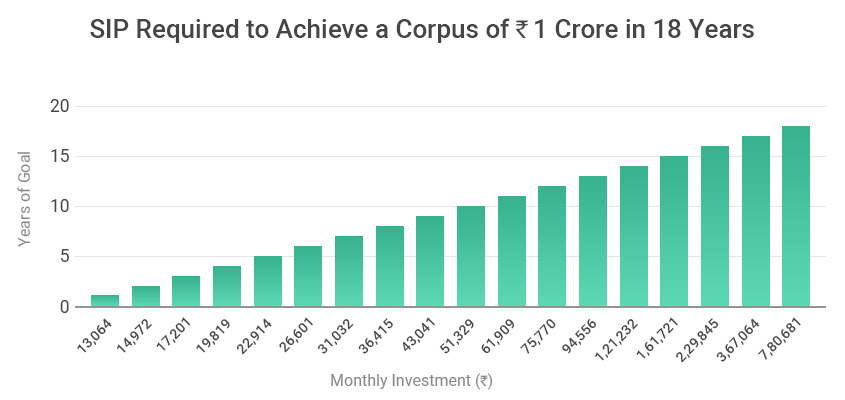

As evident in the above graph, if you start investing for your child’s education when he is 1 year old, you only need to invest 13,064 to achieve a corpus of 1 Crores. But if you wait till your child is 10 years old then you will have to shell out 51,329. That’s 293% more!

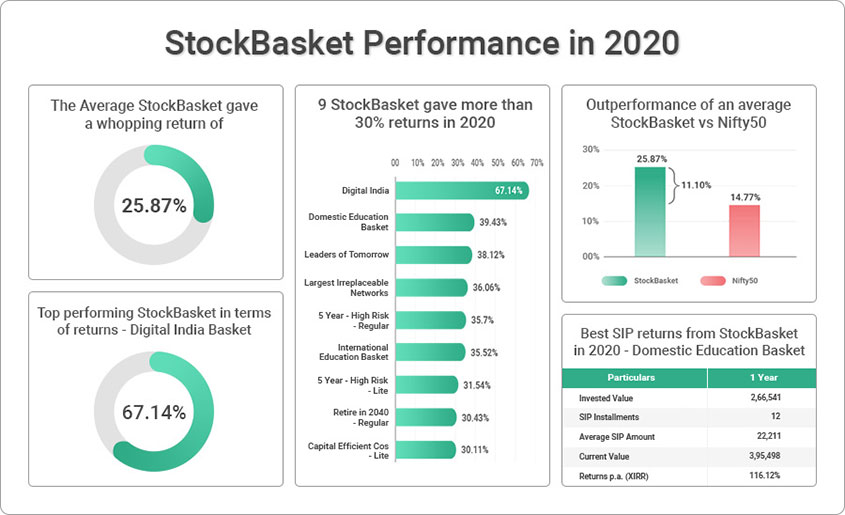

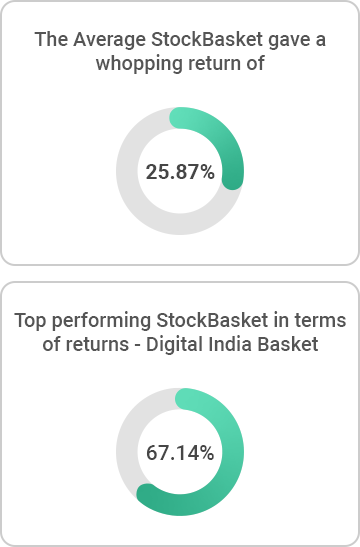

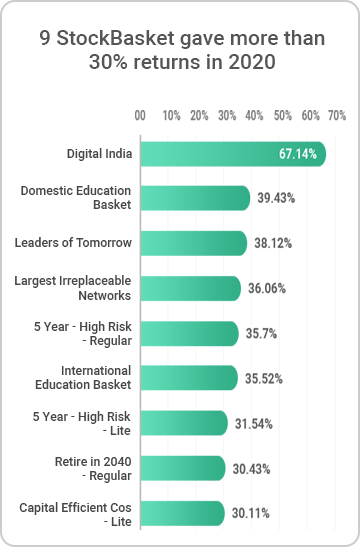

All because you delayed education planning by 10 years! So, stop delaying your child education goal and invest in the best child education plans with StockBasket. StockBasket’s International Education Basket has generated a return of 35.52% in 2020. In the same period, StockBasket’s Domestic Education Basket has generated 39.43% returns in 2020

-

Plan for International Vacations: ‘All work and no play will make anyone dull’! So while planning for child education, retirement or house purchase is important, you also need to have fun. However, the majority of us believe that international vacations are a one-off thing! This need not be the case.

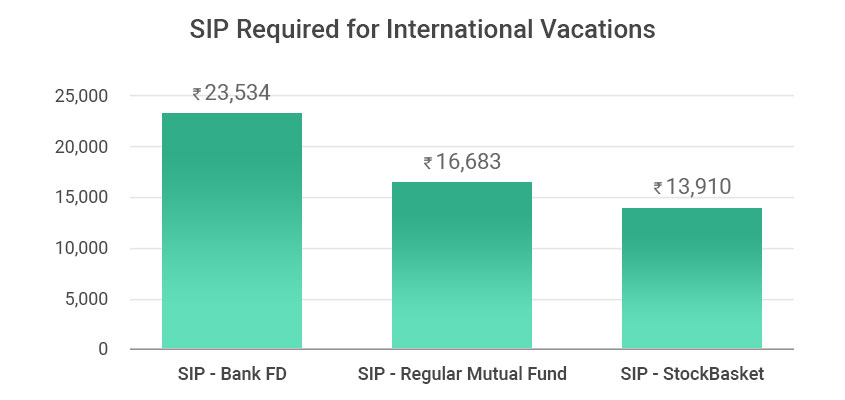

Ram is 30 years old. He plans to go on annual international vacations from 40 – 60 years. The current cost of international vacation is 3 Lakhs. Let us assume an 8% inflation rate.

Year Cost of Vacation

(in )1 3,00,000 2 3,24,000 3 3,49,920 4 3,77,914 5 4,08,147 6 4,40,798 7 4,76,062 8 5,14,147 9 5,55,279 10 5,99,701 11 6,47,677 12 6,99,492 13 7,55,451 14 8,15,887 15 8,81,158 16 9,51,651 17 10,27,783 18 11,10,005 19 11,98,806 20 12,94,710 Net Present Value 38,76,102 To go for an international vacation for the next 20 years, Ram will need a corpus of 38.76 Lakhs. Here is how Ram can achieve this corpus.

If Ram decides to invest in Bank FDs (@6%) then he will have to do an SIP of 23,534 for 10 years. But by investing in StockBasket’s International Vacation basket (@15%), Ram only has to invest 13,910.

That’s a saving of 9,625. If Ram further invested 9,625 for 10 years, he would accumulate an additional corpus of 26.81 Lakhs!

-

Retirement Planning: Retirement planning is the only financial goal that you cannot get a loan for! You can take a loan for house or car purchase, child education but not retirement. You are solely responsible for your own retirement. Hence you need to start planning for your retirement as soon as you start working.

Here are the steps for retirement planning.

-

Estimate your current household expenses. This includes grocery, light bill, gas bill etc. Remember to exclude expenses made on your children or dependent parents.

For example: Suppose your monthly expenditure is 40,000. Of this, 10,000 is spent on your kid’s tuition. Another 5,000 is given to parents. So, while planning for your retirement, you will consider monthly expenditure as 25,000 not 40,000.

- Estimate your medical expenditure. This needs to be a substantial amount. For example: you might be in great health now and only spend 500 a month on medicines. But this might not be the case when you are older. Hence overestimate your medical expenditure.

- Estimate your travel expenditure. It is recommended to include domestic or annual vacations in your retirement plan. Just because you are retired, doesn’t mean you stop having fun!

- Assume separate inflations while calculating your retirement corpus. For example: Inflation for household expenses can be considered at 8%. Whereas medical inflation should be considered at 10%-12%.

- Assume a higher life expectancy. In India, the average life expectancy is 69.27 years. Since there will be medical advancements this is expected to go up. Hence always plan for 5 more years than the average life expectancy.

- Assume a low post retirement rate of interest. Retirement planning exercise is done 25-30 years’ in the future. In the future, the interest rates are bound to fall. Hence it is important to consider a conservative return on corpus.

-

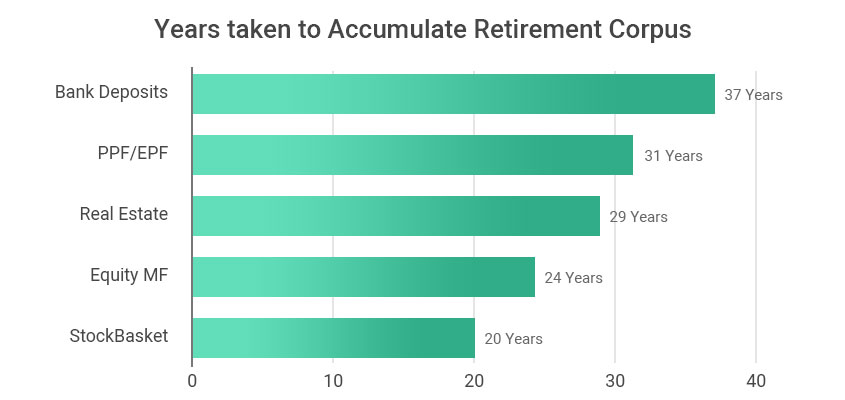

Once you find your retirement corpus, the next step is to find the best investment option to achieve your retirement corpus. Suppose your retirement corpus is 4 Crores. And you start a monthly SIP of 25,000 in below investment options. This is how quickly you can achieve your retirement corpus.

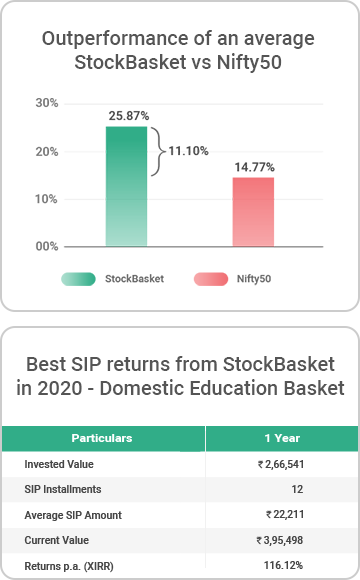

As you can see, with StockBasket you can achieve the corpus in only 20 years. But if you invest in real estate then you will achieve your corpus in 29 years! Bank deposits are the worst! So avoid them while creating your retirement corpus

-

Covering your financial risks: Majority of investors do not consider insurance planning as part of their financial goals. This is a wrong mentality, especially in case both the spouses are working. Here is why.

Suppose you and your wife both save 40,000 per month for your financial goals. Off these 40,000 your wife contributes 20,000. If both of you continue to invest for 20 years, your corpus would be 3.99 Crores.

Particulars Husband Wife SIP Amount (Husband + Wife) 20,000 20,000 Return on Investment 12% 12% Time Horizon 20 years 20 years Future Value 1,99,82,958 1,99,82,958 If both of you continue to invest for 20 years, your corpus would be 3.99 Crores.

But let’s assume due to an unfortunate event, your wife can no longer contribute towards your financial goals after the first 10 years. In this case, your corpus would be 3.44 Crores only!

Particulars Husband Wife SIP Amount (Husband + Wife) 20,000 20,000 Return on Investment 12% 12% Time Horizon 20 years 10 years Future Value - after 10 years 46,46,782 46,46,782 SIP Amount for next 10 years 20,000 0 Future Value - after 20 years 1,99,82,958 1,44,32,198 That’s 55 Lakhs less! This notional loss can be avoided by taking a health or term insurance cover.

To avoid this, it is important for you to manage your risks by investing in the following:

- Term Insurance

- Individual Personal Accidental cover

- Critical Illness cover

- Health Insurance policy for self and family.

-

Wealth Creation: This is probably the best financial goal amongst all other financial goals. The fact that you set a wealth creation goal means that your other goals are successfully achieved. Another good thing about wealth creation goal is that you can invest in ‘high risk high returns’ investments. This is because this goal is aimed at creating extra wealth and is for super long term (20+years). Hence investors can take higher risks.

While there are high return generating instruments like equity mutual funds, the best investment plan for wealth creation is ‘StockBasket’s Leaders of Tomorrow’ basket. This basket has generated a 124.95% CAGR!

There are many other such baskets which offer exceptionally high returns.

We understand that planning for each financial goal can be a daunting task for you. This is exactly why we at StockBasket have created expert curated baskets for every financial goal, from International vacation, International education to Retirement planning and wealth creation.

You have a goal? We have a basket to help you achieve these goals successfully. So, stop waiting, wondering and building castles in the air and instead build real wealth using StockBasket! Open a FREE StockBasket account today and invest in the best baskets for all your financial goals.