“Never Invest in any Business you cannot illustrate with a crayon. Some of the best businesses are found in your living room, kitchen and bathroom”

– Peter Lynch.If you observe your daily routine carefully, you will notice there are many companies whose products/services are closely tied to your life and probably a million people’s lives across the country and globe. But the question pops up, are you really taking advantage of such scenarios?

We often hear these statements during discussions – “I believe electric vehicles are the future” or “Pradhan Mantri Awas Yojana is a great initiative launched by the government to make housing affordable for all” but what are we doing to create wealth out of this? We live in a world that is ever-changing and thanks to disruptive ideas, unprecedented technological innovations, changing consumer preferences, there has been a huge paradigm shift.

Thematic investing is a form of investment strategy to identify the broader macro-level trends and the businesses and sectors that stand to benefit from the materialization of those trends. A successful investor aims at identifying these trends in advance and invest in the underlying investments and businesses. Thematic investing is all about taking advantage of these shifts by identifying and investing in companies which are most likely to benefit from such changes. It involves aligning our philosophies and beliefs with our investments.

What are Thematic funds?

Thematic funds tend to cover various sectors and identify companies within these sectors that are relevant to the primary theme. As against this, a technology fund or a health care fund would invest in specific sectoral companies only like IT and ITES companies for technology fund and pharmaceutical companies, hospital companies, health insurance companies for a health care fund. A thematic fund would invest in a theme like Emerging Technology, secular trends, ESG, outcome-oriented, rural development etc. A single theme may or may not involve multiple businesses from varied sectors. For example: Given the size of the rural population and the number of farmers in India, rural demand and consumption has been a story to look out for. Budget 2020 announced various reforms around rural upliftment. This theme stands to benefit companies that derive a significant amount of their revenues from the rural parts of India or are setting their foot in this space to benefit from it. This theme may include companies from the FMCG industry which includes household and personal care, food and beverage and healthcare segments, Insurance Industry, consumer finance, automobile sector, agricultural products sector and others.

Types of Themes

An illustrative list of the themes that investors would be interested in are listed as under;

- Environmental, Social and Governance (ESG)

- Disruptive Technology (e.g. Artificial Intelligence, Blockchain, Machine Learning)

- Healthcare

- India’s Millennial theme (e.g. Gaming, Cyber Security etc.)

- Rural India

- Infrastructure

The next big question in front of the investors is how to find sectors and businesses impacted/benefitted by these themes so as to create an effective asset allocation?

Certainly, it is difficult to analyze and identify such businesses of the future. An alternative is to invest in Thematic Mutual Funds. It functions in a similar fashion to a normal mutual fund and identifies stocks in popular future themes. Some examples of such themes could be ‘Make in India’, ‘Affordable Housing’, ‘Electric Vehicles’, Healthcare Fund, ESG Fund etc.

To explain it further, let us take an example of an ESG Fund. An ESG Mutual fund looks to invest in companies that score high on ESG parameters. Along with the traditional fundamental analysis, ESG funds further focus on non-financial factors of a company and invest in the stocks of these companies that have no evidence of any harmful environmental impact, have good corporate governance, have a commitment to corporate social responsibility (CSR) measures and refrain from indulging in any illegal practices.

StockBasket has come up with a platform giving solutions for Thematic Style of investing. At StockBasket, the experts have created Theme-based Baskets looking at the opportunities for the businesses of the future. One such theme is the Bet on India’s Millennials including stocks like Bajaj Finance, Jubilant Foodworks, United Spirits to name a few. These stocks have been identified based on the thinking patterns of the Millennials and the benefits it will pass on to the relevant businesses. An investor gets access to the benefits by investing in a particular theme/idea and future businesses.

Is Thematic Style of Investing better than Mutual funds and other asset classes like gold and fixed deposits?

The Primary clarification which everyone needs to understand is that Thematic funds are not different from Mutual funds. They are merely based on a particular theme which varies from being multi-sector, multi-economic trend etc. Since it offers diversification benefits along with higher returns, it is more likely than not that it will outperform the other asset classes like gold and fixed deposits. Having said that, it is imperative to know that exposure to a specific theme has added risks involved too. Therefore, it is advisable to create a diversified portfolio with minimal exposure to thematic funds/businesses and investments. Investing in a sector fund is equivalent to putting allof the eggs in a single basket i.e. if the basket were to underperform, all the eggs would break. We discuss the advantages and disadvantages in detail in the latter part of this article.

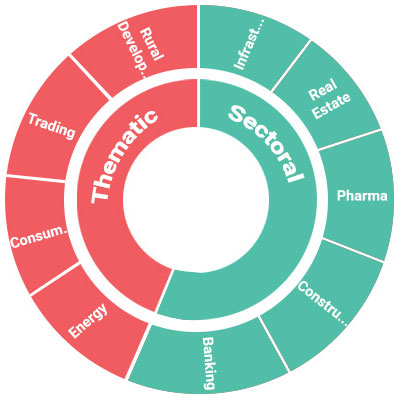

Another important distinction that needs to be addressed well by investors is between Sectoral funds and Thematic funds. Sectoral funds may be a subset of Thematic funds, but it is never the other way around.

Difference between Thematic and Sectoral funds

A Creative and systematic approach to Thematic investing:

Thematic investing is generally a top-down investment approach that primarily identifies macro-level trends and invests in the companies that stand to profit from the trend. Thematic investing involves identifying companies revolving around that trend. There are millions of strategies and investment approaches that are currently being followed across the investment horizon. To summarize and simplify it for our readers, one can follow the three-step approach to build a theme-based portfolio:

- Identifying the right trends

First and foremost, the investor has to identify the ‘Trends’ followed by the ‘Trendsetters’. How does the future look? What could be potential businesses of the future? For example, If someone has reasons to believe that Blockchain is the future and its application shall be extended to most of the sectors too. This is the trend.

Once the trend is identified, there are a few more factors that one needs to keep in mind. First, is the trend structural in nature? Does it have long term implications, or is it just short term in nature? Does the trend really create disruptions towards certain sectors and geographies? When it comes to themes, Sustainability is of paramount importance.

- Identifying sectors

After analyzing the trend correctly, one needs to look at all the sectors/businesses that could potentially benefit the occurrence of this long term trend. For example, we have identified India’s Rural Development as a future trend. Sectors such as infrastructure, automobiles, electricity, education, Health care etc. stand to benefit from upliftment of a single village. Sectoral allocation of funds is important to correctly identify the exposure to specific companies.

- Identifying companies

Following up, the investor identifies companies that could potentially be the market makers and lead the way ahead for those particular sectors capitalizing the first-mover advantage. Having a correct allocation of stocks in the portfolio is also crucial. These bets would be more from an opportunistic point of view rather than a fundamental point of view. Nevertheless, using fundamental analysis to your benefit can lead to buying companies at discounted valuations and thus offering a higher margin of safety.

One has to understand that not every company shall benefit from the theme. Only companies that make a decision quickly, operate efficiently and stand out shall benefit exponentially.

Timing is one of the most important factors in every investment opportunity. These themes could postpone the success as well. Patience is the key for long term returns. Defence and Rural Development have been in the watchlist for my investors for years now, but they are yet to make their mark in a big way.

Advantages of Thematic style of Investing

- Thematic investing helps you to capitalize on future trends. Due to its forward- looking nature, it helps you to invest in ‘Businesses of the Future’.

- Unlike Mutual funds which provide diversification, thematic style of investing provides concentrated exposure to themes, ideas, events, government policies etc. and invests in related sectors and stocks providing very limited diversification.

- Thematic Investing requires a decisive understanding of the impact of all trends on various regions and sectors as well as a forward-looking thought process to be able to understand future trends. Hence, this approach is best suited for investors who have a good knowledge and understanding of the businesses.

- Since thematic investing constantly focuses on trends and disruptive changes in the world, it can act as a portfolio hedge.

- Thematic investing provides investors with an opportunity to generate alpha (excess return over its benchmark).

Disadvantages of Thematic Investing

- There is a high risk in thematic funds as you are dependent on a specific idea or theme which may or may not fetch high returns, especially during various market cycles. This is equivalent to putting all your eggs in one basket, as mentioned before.

- If you are an investor in thematic mutual funds, the expense ratio would be on the higher side as compared to other mutual funds. The higher management fees are justified as it requires deep analysis and strong research and understanding to identify a theme, sectors and businesses within.