We all know what happened during the race. But nobody knows what happened next. Well, here it goes...

The hare was disappointed after losing the race. He did some soul searching and realised that he had lost the race because of his carelessness and overconfidence. So he went back to the tortoise and asked him for another race but this time with a different challenge. The hare challenged the tortoise in a loud and confident tone, ‘Meet me after 10 years, let’s see who gets rich faster.’ And walked away.

Instantly, the tortoise started searching for investment options. He decided that he will be investing Rs 10,000 every month starting today for 10 years at an interest rate of 10% per annum.

After 5 years, the hare spotted the tortoise visiting an investment company. He stalked him for a while and came to know that the tortoise has been investing Rs 10,000 every month.

He thought to himself, I still got 5 years in hand. I’ll invest double of what tortoise has been investing. So with a goofy smile, thinking that no one could ever defeat him he starts investing Rs 20,000 every month for 5 years at an interest rate of 10% per annum.

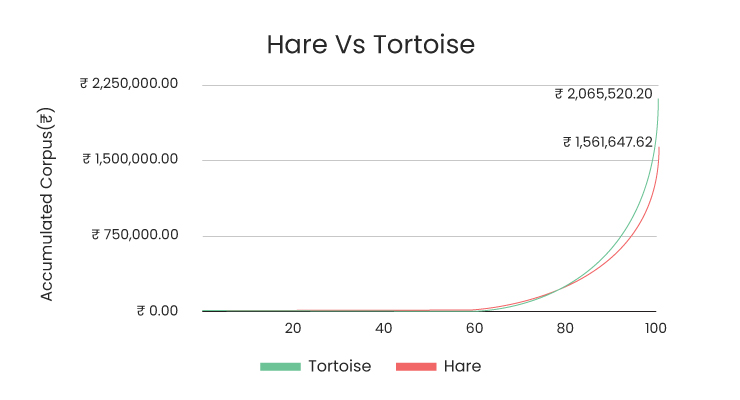

After 10 years the hare and the tortoise met and this was their accumulated corpus.

By investing consistently in the last 10 years, tortoise had accumulated Rs 20,65,620. But even after doubling his investment, Hare’s accumulated corpus was only Rs 15,61,647. This is the power of compounding!

So What is the Power of Compounding?

The power of compounding is an investment strategy that makes your money work for you. Compounding has a simple mechanism. The interest you earn on your investments is reinvested at the same rate. So, you earn interest on your principal amount as well as the accumulated interest amount. It creates a snowball effect and you end up accumulating a huge corpus. Legendary investor Warren Buffett has doubled, tripled even quadrupled his wealth with the power of compounding.

In the world of compounding, slow and consistency will help you win the race

Let's understand how you can take this power to your investments!

Follow these simple things to put the eighth wonder of the world at work and grow your wealth.

1. Time is the biggest contributor to creating wealth. So, you must start investing early for the super-power of compounding to truly work.

Recall that the tortoise invested a lower amount on a monthly basis than the hare but he started early which made his wealth compound faster.

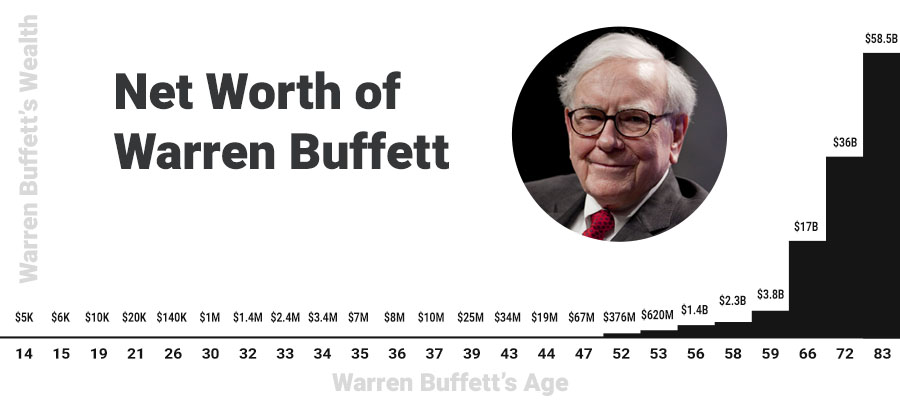

If we look beyond this hypothetical example, we have a legendary investor whose wealth creation journey started at the age of 11. We are referring to Mr Warren Buffett.

The secret to Warren Buffett’s enormous wealth is time. According to Warren Buffett, the more time your investment has to grow, the greater power of compounding it will achieve.Let’s see how Warren Buffett took advantage of time to create infinite wealth.

On his 59th birthday, Warren Buffett’s net worth was only $3.8 US Billion.

- In 6 years, his wealth multiplied 4 times!

- In 12 years, his wealth multiplied 9 times!!

- In 18 years, his wealth multiplied 15 times!!!

- At the age of 91 his net worth is $87.5 billion. So, his wealth has multiplied by 22 times in the last 32 years!!!!

Power of Compounding is practically a Superpower.

But investing early is winning only half the game. The second most important thing is to stay disciplined.

2. Be a Consistent Investor

Investing with consistency is a must. Don’t stop investing especially when the stock market is falling. Rather, a falling market is the best time to increase your investments.

Let us take the following example to understand why consistency and starting early is important for power of compounding to work.

Assume there are two friends Mr Late and Mr Early who wish to retire by the age of 60. Mr Early starts investing at the age of 25 with a monthly SIP of Rs 5,000 at an interest rate of 15% per annum for 35 years. Whereas, Mr Late starts at the age of 35 and invests Rs 15,000 per month at an interest rate of 15% per annum for 25 years.

The total invested corpus of Mr Early is Rs. 21 lakhs. Whereas, the invested corpus of Mr Late is Rs 45 lakhs.

Now can you imagine whose retirement corpus is bigger? Is it Mr Late as he invested 24 lakhs more than Mr Early?

Well, you will be surprised to know that Mr Late only had a retirement corpus of Rs 4.13 crores. Whereas Mr. Early had a retirement corpus of whopping Rs 5.70 crores. This is the result of staying consistent and staring early.

3. Invest for the long term

As the saying goes, the more time your investments has to grow, the greater power of compounding it will achieve.

But how long is long-term?

It totally depends on your investment objective. For the tortoise, it was 10 years. For the person who wishes to secure his retirement, it is 30 years. So, you need to analyse your goal and set your investment tenure.

Ask yourself. What is the goal you need to invest for? Is it saving for your child’s education? Or saving for a new car? Both will have different tenures. Your tenure of investing will be equivalent to the time horizon you will need to fulfil your goal.

Now comes the biggest question of all times - Where should I invest to gain optimum results from the power of compounding.

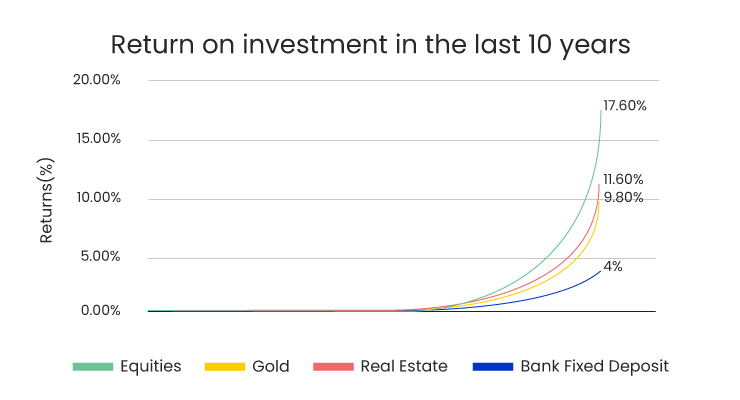

I know you might be thinking of bank fixed deposits because that’s where our parents used to invest. But today bank FDs have lost their charm. They barely provide you inflation-beating returns.

Considering the rule of 72. If your Bank FD offers you a 5% interest rate, your investment will double after 14.4 years (72/5)! That’s a long time.

So, what is the best alternative? Well, it is investing in great quality stocks and diversifying your portfolio. Over the years, stocks are the only investment option that has offered superior returns than any other investment option.

Source: RBI and BSE website

But finding great quality stocks is indeed a tedious task! You need to put in lots of effort and spend time reading thousands of pages, millions of data points to analyse quality stocks. The process doesn’t end here. After investing you will also have to monitor your investments and what not! Seems daunting? Feels impossible to do? Don't worry, we’ve got you covered with StockBasket.

What is StockBasket?

StockBasket is India’s first long term buy and hold investing platform. It has expert-curated baskets of stocks or mini portfolios of top quality companies for you to invest in just a few clicks!!

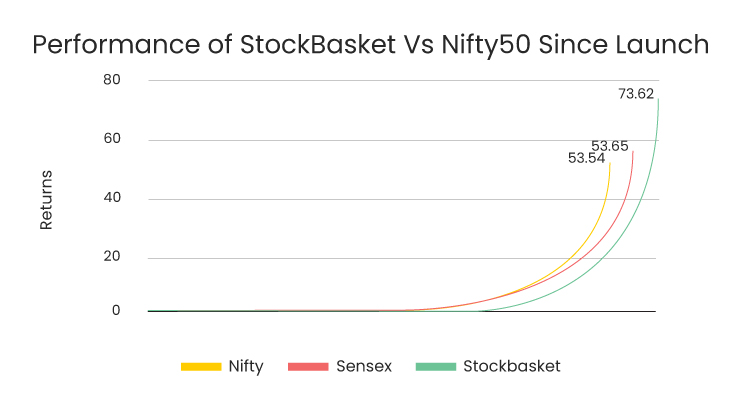

Data from 30th September 2019 - 30th September 2021

Our experts with tons of experience have handpicked top stocks in the form of baskets so that you don’t have to do the hard work!

We give you a solution with our Giga trading technology and algorithms, where you could invest in a ready-made basket of stocks and use technology to manage these mini portfolios or baskets

Our proprietary engine evaluates over 2 crore data points to determine the quality of the stocks in your baskets every day, reducing the risks of your investments to a minimum.

We have ready-made baskets for all your investment needs.

- 4x Target in 10 years

- Focused compounders

- Domestic education basket

- International vacation baske

- Retire in 2040 basket

- International education basket

- India’s wealth compounders and a lot more..

All you need to do is analyse your goal and invest in a particular basket.

Click here to explore all baskets.

Summary

The power of compounding is the real magic behind every successful investor. It can make you rich in the long term. But for the power of compounding to work, you need to invest in great quality stocks and stay invested for the long term. Both of these prerequisites are fulfilled single-handedly by StockBasket. You can explore our top baskets for absolutely FREE by opening a FREE StockBasket account. Remember to invest in top-quality stocks with StockBasket and hold them for at least 5 years to see the magic of compounding unfold!