2020 is a year to be forgotten as Coronavirus (CoV), a large family of viruses, continues to spread across the globe leading to millions of casualties. With an increase in Covid-19 cases and deaths worldwide, the World Health Organization declared the virus a pandemic in the second week of March 2020 and India immediately announced a lockdown. As cases rose, extensions in lockdown continued and this led to a massive halt in the functioning of the entire economy. Within approximately 2.5 months of lockdown, a number of companies witnessed minimal to zero sales, no transport or trade of goods, shutdown of factories, migration of labour and a number of bottlenecks to restart their supply chain. Indian retailers selling non-essential items like automobiles, furniture, clothes, luxury items etc. were hit hard as their daily wages came to a grinding halt. In fact, major brokerage houses estimate India’s GDP to decline by around 5% in FY20. As some companies struggle to remain afloat, the majority of them are expecting a significant decline in revenues and earnings. The pandemic has led to an erosion of demand globally and the lockdown has impacted supply chains. To tackle this slowdown and revive the economy, the Indian Government came up with a Rs 20 lakh crore stimulus package which was a mix of fiscal & monetary support, ease of doing business, as well as some fundamental reforms.But even after this infusion, a lot of pain is expected as India battles through a recession and a pandemic simultaneously with no immediate vaccine in sight...

Breaking down each industry will help us analyse how Covid has affected various sections of the economy and if an ease in lockdown along with various infusions have helped to improve demand.

FMCG

This sector contributes significantly to our GDP - the 4th largest sector in our economy. As Covid-19 sweeps the world, consumers are being forced to dramatically change their purchasing behavior. Market research firm Nielsen has slashed its 2020 growth outlook for India’s fast moving consumer goods sector to 5-6% from its earlier projection of 9-10% as it expects the impact of covid-19 to play out through the year. FMCG industries selling essentials have been doing well on the demand front, but are being affected due to supply chain breakdowns, stockpiling and stockouts. On the other hand, discretionary products have taken a backseat. Most companies had shut down or cut down their operations during the lockdown. However, some companies transformed their capacities to produce essential products like hand sanitizers, masks and ventilators, that aid the Government in fighting the pandemic. In India, post the outbreak, demand for health and hygiene products has risen exponentially. Increasing awareness among Indian consumers related to hygiene is anticipated to create opportunities for many domestic and international players till 2022.

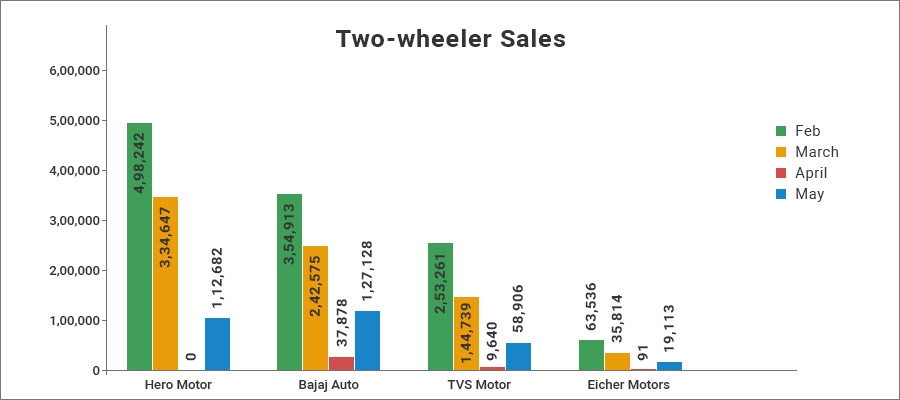

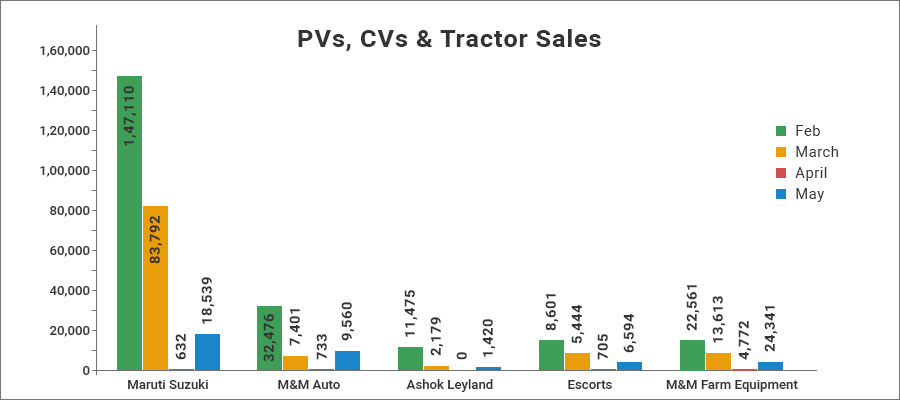

Automobiles

The automobile sector (pre-covid) contributed to about 50 % of the manufacturing GDP in India, 26 % of the industry GDP and 7.1 % of overall GDP. A lot of other ancillary sectors such as steel, iron, rubber, oil, glass, etc rely on automobiles for revenue. The Indian Auto industry has already been under pressure for over a year, and now the pandemic has made the situation even worse. Sale volumes had dropped drastically with 0 domestic sales recorded in April for the first time ever. No relief is seen for the sector in the near term. Currently, demand is hovering around 20% of normal levels led by a relatively faster recovery in the rural areas. People will be looking to shift to a lower range of vehicles, however financing remains a major constraint as the percentage of automobile buyers opting for moratorium has been the highest. Farming segment and tractors are expected to recover the fastest, followed by two-wheelers. Overall the sector is facing challenges on both the supply and demand side which makes things look very bleak for the next 6 months. Although people are expected to shift to personal mobility from shared mobility the challenges for this sector outweigh the opportunities by a huge margin.

Real Estate

This industry has been derailed by Covid-19. Construction requires more than 200 items with dependence on China for various raw materials leading to supply chain disruption. There is a lot of uncertainty going forward in the real estate space.Customers have canceled bookings and construction is getting delayed. Another major problem is of migrant workers returning back home. There could be a possible wage hike due to demand supply imbalance. Residential property sales have almost collapsed since the lockdown. Given the economic impact of COVID-19 and uncertain income/jobs outlook, the path to normalcy could be longer. Being a discretionary purchase, property sales will remain low for a while. Although the RBI has given sufficient liquidity to banks they have not been lending money as expected due to lack of confidence in the current market. This could be a major harbinger to boost sales. However, on a positive front, people are expected to upgrade to bigger houses as Work from Home as an idea and philosophy is here to stay.

Telecom

The only sector to gain demand amidst coronavirus is the telecom sector. It is the invisible hand that is enabling people to work from home and maintain social distancing. Remote working, video conferencing, and telecommunications technology have enabled business operations during this lockdown, and streaming services such as Netflix, Amazon have become the go to source for entertainment. According to news reports, overall traffic has jumped by 10% and streaming platforms have witnessed a 20% spike in viewership. But due to the lockdown, subscriber additions will be lower.

Banking & Finance

This sector is one of the worst hit due to the pandemic and it will face challenges on two fronts - credit growth and asset quality. Lack of collections on interest obligations could cause a big dent to a financial institution’s cash flows. There is a huge risk of increase in defaults on loans given to the SME & MSME segment and unsecured loans (personal loans, credit cards). Amidst these stressful times, the lenders are permitted to allow 3 months moratorium to borrowers for term loans, which was further extended by another 3 months, totaling to 6 months. Although moratorium would help in assisting the temporary liquidity mismatch, it would only delay the recognition of defaults for the inevitable cases. On the loan growth fund, with discretionary consumption likely to get affected, loan growth could slow down across segments.

Aviation

All aspects of the aviation space have taken a hit and it’s uncertain what irreversible damage it will do to the sector. With the closure of borders to prevent transmission of the virus, all flights had been cancelled internationally as well as domestically during the lockdown. The Government has announced resumption of domestic flight operations from 25th May but at less than half the capacity and a number of safety procedures. Moreover, with partial shutdowns at airports and other state specific rules, running the business profitably is a huge challenge. To add to it, fare caps have been enforced to allow a fair ground for all players without hampering the end user. Hence, it would potentially be a long road to recovery as there are insurmountable challenges and people will travel less due to the virus fear.

Travel & Tourism

The Indian tourism industry is expected to lose revenues of Rs 1.25 trillion in 2020 as the pandemic has led to shutdown of hotels and suspension in flight operations. Due to various travel restrictions imposed by both the Indian Government as well as governments across the world, bookings for Hotels, flights, conferences & tourist activities have been cancelled. The restaurant industry in India is expecting almost zero revenue in the immediate term and a drop of 50% in the months to come. Together with a decreased willingness to travel, the restrictions have had a negative economic impact on the travel sector. There is expected to be a possible shift from business travels and conferences to virtual and online meetings in the long term.

Pharmaceutical

This sector has taken the center-stage amidst Coronavirus. India is the world’s largest generic player with 50% share in vaccines and 20% share of the total market. Being a health issue it is expected the pharmaceutical sector would have benefitted the most but this is a myth. Factories are not running at full capacity, availability of manpower is an issue, new launches may see delays and the supply chain disruption is a cause for concern. Given that most of India’s active pharmaceutical ingredients and key starting materials are imported from China, supplies were disrupted for several weeks due to the situation in China. As a result of the lockdowns and closures, slowed production of APIs resulted in less availability and higher costs for the materials required for generics production. Not just the production, even research and development exercises were impacted. But on a positive note, the outbreak has presented the Indian pharmaceutical industry an opportunity to become an alternate hub for manufacturing APIs and intermediates.