Majority of investors today invest for their financial goals in mutual funds and not direct equity. Investors believe that direct equities, or stocks are too risky. But what they fail to understand is that even your mutual funds invest in stocks only! So, while indirectly, when you invest in mutual funds, you end up investing in the stock market!

It is a fact that good quality stocks generate superior returns than mutual funds. For example: Bajaj Finance Limited, generated a return of 141.23% between 6th May 2020 to 7th January 2021.

Such returns are not available when you invest in mutual funds. But still investors prefer investing in mutual funds because they can start investing from a small amount, which they think is not possible in stocks.

But what if there was a way of investing in top quality stocks through a SIP?

Surprised?

Yes, now you can do a SIP in equity stocks as well. This is known as an Equity SIP.

What is an Equity SIP?

Equity SIP is buying shares of a company at regular intervals. Once you buy these shares, you become a part owner of that company. As a part owner of the company, you enjoy its profits, dividends and future growth.

What are the types of Equity SIP?

Equity SIPs can be of two types:

- Amount based SIP: In an amount based equity SIP, the investor decides a fixed amount to be invested each month/quarter/year in the particular stock/mutual fund for a specific time period.

- Quantity based SIP: In a quantity based equity SIP, the investor decides a fixed quantity of shares to be purchased each month/quarter/year of a particular stock for a specific time period.

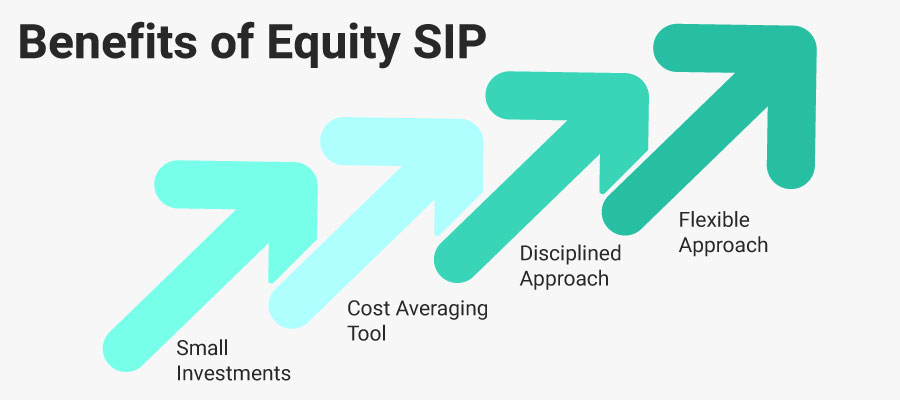

What are the benefits of Equity SIP?

- Small Investments: Equity SIPs can be started with a small amount of money invested at regular intervals. Investing in best equity SIP can be done without the burden of investing in one go.

-

Cost Averaging tool: Rupee-Cost Averaging is a strategy to reduce the impact of volatility by spreading out your purchases. This ensures that you are not buying shares at a high price. Rupee-cost averaging is buying at regular intervals and in roughly equal amounts.

Cost averaging technique will help if a company misses quarterly estimates and the stock goes down. If the entire market nosedives vertically giving negative returns and pushes the stock prices down with it, the investor can look to add more quantity of the same stock at deep discounts and lower its weighted average cost of investment, provided the business model of a particular investment is fundamentally viable and feasible - overall it should be good company. - Power of Compounding: As Warren Buffett has aptly remarked, ‘My wealth has come from a combination of living in America, Some lucky genes and Compound Interest’. Compound Interest is when you earn interest on your interest.

- Disciplined approach: Equity SIP is a simple and disciplined approach towards investment. SIPs are generally linked to an auto-debit mandate i.e at specified date your chosen amount will be automatically debited from your bank & invested in equities.

- Flexible approach: In Equity SIP, investors can decide the amount or the quantity of investment as well as the gap between two intervals. However, regular SIP investments have higher chances of success in the long term.

Who should Invest in Equity SIP?

- A long-term investor, who knows wealth can only be created by staying invested in quality stocks for a long period.

- A student, who wants to make an investment for the first time.

- A salaried professional, who started working a few months or years back and has saved up some money to invest in a good and safe asset class.

- A seasoned investor, who has created some wealth in equity markets and understands the nitty-gritties of the stock market.

- A senior management professional, who does not have the time to track markets but wants to create wealth in the stock market.

So basically, Equity SIP is for anyone and everyone who are interested in long term investments.

Why StockBasket SIP is the Best Equity SIP in India?

While Equity SIPs generate higher returns, it does come with high risk. Hence, it is very important to make an informed decision when selecting a stock for the equity SIP. The best way to do an equity SIP is via StockBasket. StockBasket - India’s first long-term buy and hold investment platform.

- Expert selected stocks: StockBasket comprises well-researched stocks, shortlisted by experts using StockBasket’s proprietary AI and machine learning platform.

- Continuous monitoring: Expert research analysts monitor all stocks of StockBasket regularly in individual capacity as well as a part of a portfolio. Changes are made if and when necessary.

- Dividends: Dividends paid by the company are directly transferred in the investors account.

- Low-cost model: StockBasket follows a flat fee structure i.e. the fees charged per basket does not change with the value of the basket. The average cost of holding a basket comes to about 1.5% p.a., which is 1% less than many regular equity mutual fund schemes. With time, the value of your investments go up, thus the fees charged goes down in percentage terms.

- Control: Investors have sole control over their portfolio unlike a PMS or mutual fund scheme.

- Avoiding Over-diversification: Mutual fund schemes own stocks ranging anywhere from 25 to over a 100, which leads to too much diversification. It could also hamstring investors from earning higher returns.

- Long term approach: StockBasket works on a ‘buy and forget’ philosophy. StockBasket’s stocks pass the ‘5-year Bond test’. This test is such that even if the markets shut for 5 years from tomorrow meaning that we will not be able to sell or make changes to our portfolios, we will sleep peacefully. This test helps us to shortlist stocks that would survive as well grow with great amounts of certainty.

- 5-year fee refund guarantee: This is StockBasket’s most unique and powerful feature. When an investor invests via StockBasket, they are in essence subscribing to Samco’s research. It is based on the principle of - “We Don’t Make Money, If you Don’t”. It means that if you lose money in a particular basket even after holding it for a period of 5 years then the subscription fee collected over 5 years will be refunded to you.

When is the right time to start an Equity SIP?

As a popular Chinese proverb goes, ‘The best time to plant a tree was 20 years ago. The second best time is now’.

Similarly, there is no ‘correct’ time to start an equity SIP. The best time to start an equity SIP is ’NOW’. One of the most important benefits of equity SIP is that investors no longer have to time the stock market. They can continue investing through market ups and downs.

But before you start investing, here’s how StockBasket has generated superior returns.

| Sr No. |

Basket Name | 5 years Return (%) |

|---|---|---|

| 1 | Health and Wellness | 48.6 |

| 2 | International Education Basket | 35.41 |

| 3 | Domestic Education Basket | 34.54 |

| 4 | Digital India | 33.62 |

| 5 | 4X Target in 10 Years - Lite | 28.36 |

| 6 | 5 Year - High Risk - Regular | 28.35 |

| 7 | 4X Target in 10 Years | 26.28 |

| 8 | Bet on India's Millennials | 25.13 |

| 9 | Retire in 2040 - Regular | 24.7 |

| 10 | Largest Irreplaceable Networks | 24.24 |

| 11 | Home and Home Decor | 22.89 |

| 12 | Capital Efficient Cos - Lite | 22.63 |

| 13 | Market Leaders India | 22.52 |

| 14 | 5 Year - High Risk - Lite | 22.39 |

| 15 | Value Buy 2020 Basket | 21.98 |

| 16 | Leaders of Tomorrow | 21.83 |

| 17 | Top MNCs India - Lite | 21.5 |

| 18 | Capital Efficient Cos | 21.35 |

| 19 | 5 Year - Low Risk - Regular | 21.34 |

| 20 | TOP MNCs India - Regular | 21.17 |

| 21 | Dividend Champions | 21.14 |

| 22 | Retire in 2040 - Lite | 20.8 |

| 23 | India's Wealth Compounders | 19.92 |

| 24 | India's Biggest Brands | 15.5 |

| 25 | 5 Year - Low Risk - Lite | 15.07 |

| 26 | Beginners Basket - Lite | 12.72 |

| 27 | International Vacation Basket | 10.82 |

| 28 | Urbanisation of Rural India | 9.84 |

*Returns calculated as on 29th Jan 2021 (Note: Returns calculated before 30th Sep 2019 are backtested results)