Do you have 2,00,00,000?

If not, you might be in really big trouble. Luckily, we have a strategy to help you out.

But first, do you have 2 Crores to secure your child’s future?

Did you know that an MBBS costing 30 Lakhs today, will cost you a whopping 2.01 Crores after 20 years!

Engineering is no different.

An Engineering degree that costs 10 Lakhs today will cost 67 Lakhs in 20 years! This is while assuming a conservative 10% inflation rate.

If you assume a 12% inflation rate, then a 30 Lakh MBBS degree will cost 2.89 Crores in 20 years!

Scary right? But the situation worsens if we look at International Education.

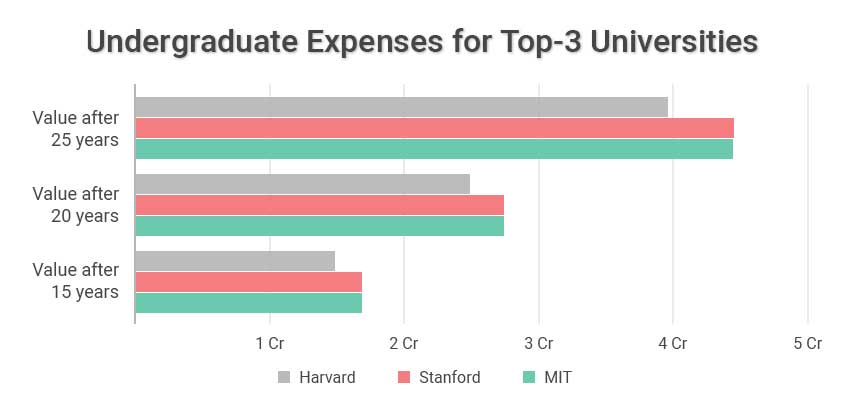

| MIT | Stanford | Harvard | |

|---|---|---|---|

| Value after 15 years | 1,70,36,270 | 1,70,43,336 | 1,52,55,219 |

| Value after 20 years | 2,74,37,083 | 2,74,48,463 | 2,45,68,683 |

| Value after 25 years | 4,41,87,696 | 4,42,06,024 | 3,95,68,109 |

As you can see, an undergraduate degree in the USA will cost you an average 2.64 Crores in 20 years!

As a parent you have an uphill battle.

You have limited time and resources. Hence the best way to plan for your Child’s Education is by following a 3-step approach to Child Education Planning.

3-Step Approach to Child Education Planning

Step 1: Child Education Planning – Creating a Blueprint

Having a solid yet realistic blueprint is critical while planning for your Child’s Education. Here is a step-by-step approach to creating Child Education Planning blueprint:

Decide on the current value of your goal. While it is difficult to guess what your child will become in the future, you should ideally set a higher corpus.

So, even if your son ends up becoming a lawyer, there is no harm in planning for an MBBS corpus.

Overachieving a goal is not a bad thing.

Time to the goal is the difference between your child’s current age and the graduation year. So, if your child is 5 years old, starting higher education at 18, then your time to the goal is 13 years (18-5).

Inflation is the biggest enemy while planning for your Child’s Education. Ideally, a 10% inflation rate should be considered for Domestic Education. A 12% inflation rate should be considered for International Education.

The final step in Child Education Planning is to find out the Lumpsum or SIP required to accumulate the corpus. After that you simply need to invest in the Best Child Education Plan.

Step 2: Child Education Planning – Starting Early

The early bird gets the worm – a lesson taught to children is applicable to us as well.

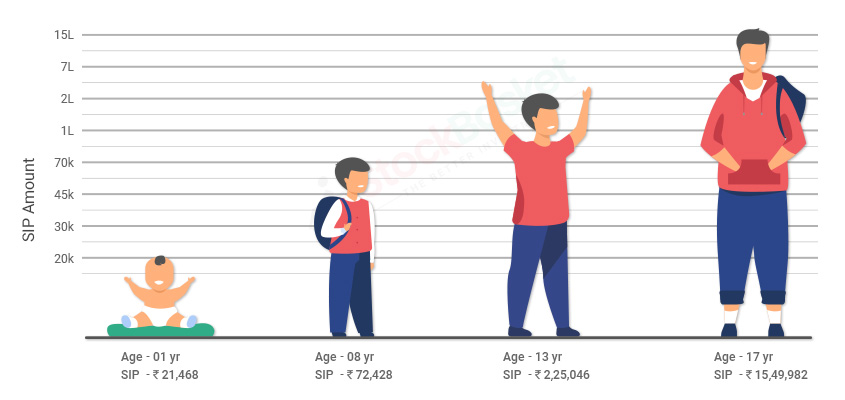

Creating a corpus of 2 Crore might seem daunting for a common man. But all you need to do is start early.

The below table reveals the SIP required to achieve a 2.01 Crore corpus with reducing years to goal.

| Starting Age | Goal Age | Target Corpus (in Rs) |

SIP Required (in Rs) |

SIP Increase |

|---|---|---|---|---|

| 1 | 18 | 2,01,82,500 | 21,468 | - |

| 2 | 18 | 2,01,82,500 | 25,269 | 17.71% |

| 3 | 18 | 2,01,82,500 | 29,818 | 18.00% |

| 4 | 18 | 2,01,82,500 | 35,290 | 18.35% |

| 5 | 18 | 2,01,82,500 | 41,917 | 18.78% |

| 6 | 18 | 2,01,82,500 | 50,008 | 19.30% |

| 7 | 18 | 2,01,82,500 | 59,982 | 19.95% |

| 8 | 18 | 2,01,82,500 | 72,428 | 20.75% |

| 9 | 18 | 2,01,82,500 | 88,192 | 21.77% |

| 10 | 18 | 2,01,82,500 | 1,08,545 | 23.08% |

| 11 | 18 | 2,01,82,500 | 1,35,482 | 24.82% |

| 12 | 18 | 2,01,82,500 | 1,72,324 | 27.19% |

| 13 | 18 | 2,01,82,500 | 2,25,046 | 30.59% |

| 14 | 18 | 2,01,82,500 | 3,05,593 | 35.79% |

| 15 | 18 | 2,01,82,500 | 4,41,829 | 44.58% |

| 16 | 18 | 2,01,82,500 | 7,17,334 | 62.36% |

| 17 | 18 | 2,01,82,500 | 15,49,982 | 116.08% |

- If you start planning when your child is only 1 year old, you need to do a SIP of only 21,468.

- But if you delay Child Education Planning by 5 years, then you will have to do a SIP of 50,008.

This is a 133% increase!

So, the longer you wait to start investing for your child’s education, the higher are your chances of failure.

Step 3: Child Education Planning – Selecting the ‘Right’ Child Education Plan

In India, Child Education Planning has been ‘Marketed’ as ‘Insurance Planning’. Parents are trapped into buying stale insurance policies thinking this is the best way to plan for their child’s future.

Unfortunately, this one mistake can ruin your entire Child Education Planning.

Buying an insurance policy is not the same as planning for your child’s education. Insurance is and should always be used as a ‘Risk Management’ tool. It is not for investment purposes.

So, STOP buying child education-based insurance policies. They will NOT help you secure your child’s education.

Apart from insurance, investors often invest in the below investment options as part of Child Education Planning. Let us understand these options in detail.

1. Real Estate: Real Estate is very popular among investors as it is a tangible asset. You can see it, feel it and it gives you a mental satisfaction of ‘Ownership’.

But is land or an apartment the best child education plan?

No! Real estate is a highly illiquid asset. You cannot sell it at a moment’s notice. It also comes with high costs – brokerage, maintenance etc. The biggest drawback of real estate as a child education plan is the high taxes.

When you sell real estate, you have two options –

- Invest in another property within 3 years

- Pay 20% tax on capital gains or invest in capital gains bonds for 5 years!

Since you need the money for your child’s education, option number 1 is out of the question.

The second option is to invest in a capital gains bond for 5 years! But you need to fund your child’s education now not after 5 years! So, either you sell your property minimum 5 years before your child’s education goal or you pay 20% tax.

The average return generated by real estate is in the 7%-8% range. Post-tax, the returns come down to 5.6% - 6.4%! With such mediocre returns, your child education plan is surely set up for failure.

2. Sukanya Samriddhi Yojana (SSY): Sukanya Samriddhi Yojana is considered to be the best child education plan available in India. It is also marketed like a godsend for your child.

But there are some major flaws in the scheme.

- The scheme is only for girl child.

- The scheme generates average 8%-8.5% returns.

But the education inflation in the country is 10%. So, you are earning a negative real rate of return. Hence, Sukanya Samriddhi Yojana is not the best child education plan in India.

3. Public Provident Fund (PPF): PPF is a great debt-based child education plan. But again, liquidity is a major flaw. PPF is locked-in for 15 years. Partial withdrawal is allowed from the 5th year. But you can withdraw only 50% of the total balance.

Another issue is the average 7.5% - 8% returns which translates to 6%-6.4% post-tax returns. Your real returns are again negative 2%-3%. So, while PPF is a great debt investment, it is not the best child education plan.

4. Mutual Funds: Equity mutual funds can be considered as one of the best child education plans. It has generated 12%-15% annual returns.

Equity mutual funds do not carry high lock-in periods like PPF or SSY. But mutual funds charge you 1%-2% expense ratio which reduces your overall returns.

But what if there was a way to plan for your child’s education without paying high charges?

Another issue with mutual funds is that they are over-diversified. A typical mutual fund consists of 60+ stocks.

What are the chances of all 60 stocks being outperformers? Very slim.

5. Stocks: Stocks are the best child education plan in India. They offer highest liquidity and superior returns.

Stocks like TCS have generated an annualised return of as high as 21% in the last 5 years. (4th March 2016 - 4th March 2021)

But even stocks have a major flaw. There are more than 4500+ stocks in the market. Of these, only 70-80 stocks are worth investing.

So, the probability of you picking the right stock is 0.0002!

Hence while stocks are the best child education plan, investors end up investing in mediocre stocks.

If only there was a way to invest in all the best quality stocks for your child’s education.

Introducing the Best Child Education plan in India – StockBasket

What is StockBasket?

StockBasket is India's first long term buy and hold investing platform. StockBaskets are expert-curated ready-made baskets of 5-15 stocks. So, you invest in the best stocks without unnecessary diversification.

StockBasket’s unique proprietary engine evaluates more than 2 Crore data points daily based on 60+ Intelligent Parameters.

Based on this analysis, StockBasket has curated 2 unique and special baskets dedicated to Child Education Planning.

- Domestic Education Basket

- International Education Basket

Some Interesting facts about the ‘Domestic Education Basket’

- The 1-year XIRR [AS3] (not absolute) return generated by Domestic Education Basket is 89.78%!

If you think we are a one-shot wonder then think again…

- The 3-year returns are 37.46%!

- The 10-year returns are 32.77%!

- The 20-year returns are 35.36%!

* Returns calculated before 30th Sept 2019 are back tested results.

Similarly, the ‘International Education Basket’ has also been a consistent performer.

- In the last 1-year, the International Education basket has generated an XIRR of 76.81%!

- The 3-year returns are 32.75%!

- The 10-year returns are 32.80%!

- The 20-year returns are 31.93%!

* Returns calculated before 30th Sept 2019 are back tested results.

So, on an average both the baskets have generated an annual return of 30% and higher!

The reason behind this superior performance is StockBasket’s superior stock selection.

To give you a glimpse, HDFC Bank Ltd carries 14.39% weightage in the International Education basket.

The stock has rallied

Still thinking if StockBasket is the best child education plan? Maybe the below table will help you come to a conclusion.

Here is how much corpus you will generate in different child education plans in 15 years.

| Real Estate | Sukanya Samriddhi Yojana |

PPF | Equity Mutual Fund |

Domestic Education Basket |

International Education Basket |

|---|---|---|---|---|---|

| 73,06,820 | 89,05,973 | 85,16,535 | 1,45,86,581 | 1,96,90,796 | 2,29,80,222 |

Note: The rate of returns are as following: Real estate – 6%, SSY – 8.25%, PPF – 7.75%, Equity MF – 13.5%, Domestic Education Basket – 16.50%, International Education Basket – 18%

- By investing in the Domestic Education Basket instead of real estate, you acquire an additional 169.49% corpus!

- By investing in StockBasket’s International Education basket instead of PPF, your corpus grows by additional 170%!

So, get smart and invest in the Best Child Education Plan in India 2021 – StockBasket’s Domestic and International Education Basket!

Explore our Domestic & International Education Baskets by opening a FREE StockBasket account today!