Increasing Healthcare and wellness expenses have impacted our retirement corpus heavily. But have you ever considered that you could pay hefty medical bills to the hospitals by making profits from their shares? Well, that’s an oxymoron, but yes, that’s very much possible!

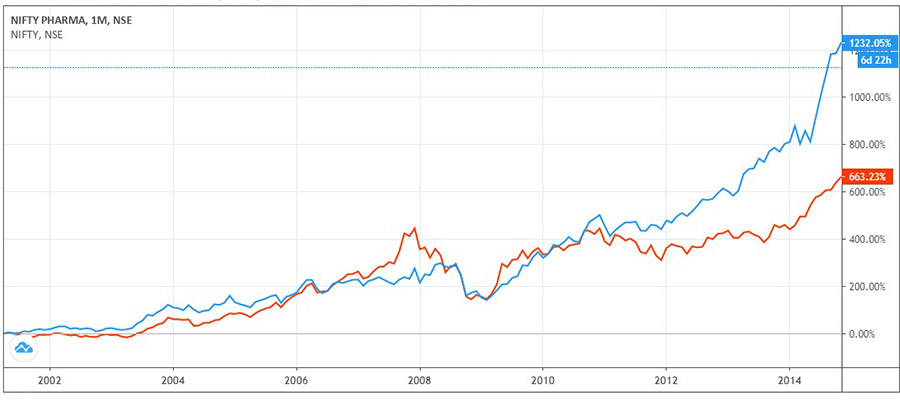

The Healthcare and Pharmaceutical sector has consistently outperformed nifty over the years. Below is a chart showing the performance of nifty 50 and NSE pharma.

The pharma sector in India had been underperforming since 2014 with the arrival of US FDA approval. The stocks had not participated in the bull run from 2014 to 2019. However, most of the population across the globe have become more cautious about the outbreak of the current virus. The importance of Healthcare is now at its peak.

Why Pharma and Healthcare business?

With pandemic hitting other sectors of the economy like a domino game starting from Travel and tourism to Banking, Coronavirus has shown a negative impact in all the sectors except Healthcare. And India being one of the prominent and rapidly growing presence in global pharmaceuticals could be the sector for a boom in the coming years. India has been a significant exporter of medicines and other pharma products to many countries across the globe. The cautious approach of the people shall create a further sustainable demand for these products in the coming future.

- Strong Global standings (Major Exporter)

It is the largest provider of generic medicines globally, occupying a 20% share in global supply by volume and 62% of global demand for vaccines. India now stands third worldwide for the production by size and 10th by value. India holds 12% of all global manufacturing sites catering to the US Market.

2. Manufacturing Hub and lower costs.

Expertise in low-cost patented drugs and a movement towards end-to-end manufacturing has improved manufacturing demand in India. Further, the shift of business from China to India shall boost the production in India to cater to the global market. Also, most of the Indian Pharma companies have shown decent growth and have taken steps to reduce their costs which makes the manufacturing even more attractive in India. The combined impact on increased volumes and lower costs shall be to improve earnings growth.

3. Innovation and R&D

Indian pharma companies have been investing a large percentage of their income for research and development. This is primarily to improve its wallet share in the export business. With more than 30 vaccines being in different stages of development in India, India holds a strong global position in the Drugs market.

4. Value picks

The Pharma and healthcare sector index had underperformed the nifty drastically over the last three years until 2019. The earnings stabilized in the second quarter of 2019, which then saw a turnaround story for most of the Indian Pharma companies. Some of the pharma companies are available at a dead cheap price, making them long term value picks. The basic idea of value investing strategy is to identify an undervalued stock in times of recession, which have corrected more because of the overreaction of the emotions of the market participants. Pharma companies had been in such a phase and therefore, could generate exponential returns for the investors in the long term.

5. Health insurance sector

With the increasing health risk and the medical costs associated with it, it has become essential to transfer (Risk sharing) to avoid financial discomfort in times of uncertainties. Life and Health Insurance is one such business with limited penetration in the Indian households, i.e. lower customer outreach as compared to the overall population of India. Most of the people fail to have an insurance policy or refrain from having adequate and sufficient insurance, i.e. underinsured. With an increase in financial literacy programs in India, the demand for insurance products is bound to increase.

Healthcare and Pharma StockBasket

Considering the decisions about Investing, Healthcare and Pharma sectors is one of the industries which every investor should be bullish on. A more vigilant approach from the consumer will bring fundamental change to the spending habits towards precautionary products.

The first step to fundamental investing is to identify the next trend – the next promising sector. In this case, we have done our bit. Secondly, choosing Stocks can be a more significant burden for any investor. But don’t worry, we have got you covered. Our research team at StockBasket has created a wellness basket and cherry-picked fundamentally sound companies with consistent growth and earnings as well as optimistic future expansion plans.

The basket is diversified across the major sectors in the healthcare space, including Indian Market leaders as well as Multinational companies.

- Indian Healthcare companies – Dr Lal Path Labs is an international service provider of diagnostic and related healthcare tests. It is the market leader in order diagnostic space and one of the fastest-growing companies.

- MNC Pharmaceuticals – To have a geographic diversification and global expertise, we have chosen the 6th largest pharma company across the globe dealing in medicines, vaccines and consumer health, i.e. GlaxoSmithKline. It develops and distributes medical products, including respiratory, oncology, vaccines, HIV, and consumer health medicines globally.

- Insurance – Considering the fact of being in Health crisis, the Insurance sector is given a maximum of weightage at 30% of the portfolio with HDFC Life and ICICI Lombard as holdings. These two firms stand on top of this sector. The former is a debt-free company, and the latter has increasing Earnings per Share.

These are strong runners that have evolved to become high-quality companies operating efficiently on the back of world-class practices and steady growth. This Stockbasket encompassed the entire healthcare value chain right from diagnostics to health insurance to diversify and manage risks. Our perfectly balanced basket would wither all the market volatility to generate our client’s superior long term returns.