With access to a lot of information, today the complex process of investing has become an easy process, yet the industry services players portray it as a complex process enough to turn over control of your money to an “expert”.

Today a common retail investor has so much access to the data, advanced tools and platforms that he can manage his portfolio effortlessly without spending a single penny on the costly expert’s fee.

By following the below strategies one can manage his own investment portfolio:

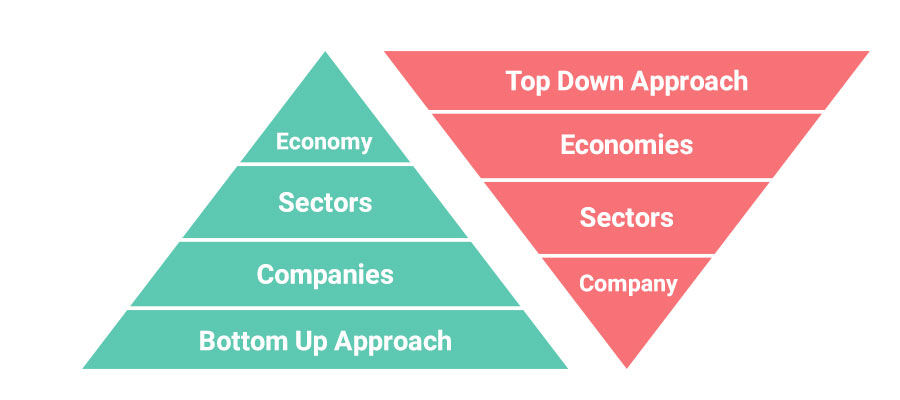

- Investment Strategy: Before planning your investment you should understand the business of the company this can be either starting to understand the sector and then the company or vice versa, understanding the economy and the sector first and then the company is called Top down approach, and understanding the company first and then the sector and the economy is called a Bottom Up Approach, you can also refer our article on Portfolio Approach v/s Stock Specific Approach to know more.

- The Margin of safety: The best approach to build your portfolio s to avoid risk and the best way to avoid risk is following the Margin of Safety. So what is a margin of safety? The margin of safety can be defined as the principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. This technique helps us to reduce the risk and give us an opportunity to buy quality businesses at a lower price in comparison to its intrinsic value.

- Invest in Businesses that you Understand: Never ever invest in a business that your friend assumes might go up or following that one good news, don’t invest in a business unless you understand the economics of the industry and can forecast it for at least a span of 5 years.

2. Risk Appetite: Stock Markets are subjected to risks and one needs to accept this fact and move ahead, you need to figure out your risk appetite on the basis your financial capacity, an investor with a good sum of money can take more risk than an investor who has less money to invest.

3. Diversification: You must have heard about the famous idiom “Don’t put all your eggs in one basket”, the keyword here is to diversify your investment, if you put all your money in just one stock, there are chances that you become super rich or you can lose all your money, there is too much risk involved in investing your money in just one stock, so to avoid this one should balance their investment and invest in multiple good quality stocks.

4. Rebalance: Rebalancing can be said as the process of realigning the weightings of your portfolio, the central idea here is to buy and sell the stocks on the basis of their performance, It is always recommended to rebalance your portfolio once in a year, but you need to constantly monitor your portfolio and rebalance timely.

Summary

Today’s investors can easily manage their portfolio, provided they pick great quality stocks. The key to creating wealth is to start early, invest in quality stocks and stay invested in them for the long term, with the magic of compounding coming in to play. This was my take on how to manage your own investment portfolio. Please comment your reviews on it.

2 Comments

This article helped me to rebalance my stock portfolio in Kotak Stock Trader app.

Before it was filled with garbage stocks. Now it looks improved as I removed unwanted stocks from my list.

We’re glad you found our article helpful!