Before jumping on to the difference between Risk Ability vs Risk tolerance, let us first understand risk tolerance

What is investing risk tolerance?

Risk tolerance is the amount of loss that an individual is prepared to handle within his/her portfolio. In layman terms, Risk tolerance is the ability of an investor to take the risk. The risk tolerance is determined by a combination of factors like his lifetime goals, timeframe, personal preferences, expertise etc. There is a difference between risk ability and willingness to take the risk. An ideal investment policy statement (IPS) would define the risk appetite as a lower of the two, i.e. lower of willingness to take risk and ability to take the risk. This is further explained in the latter part of the article.

Understand the risk tolerance

An investor needs to understand the proportion of allowed risk (willingness to take the risk) and the types of risks that the investor wishes to be exposed to. Understanding risk tolerance is an essential component of investing. Age plays a vital role in defining the overall risk tolerance. Young investors tend to have a higher ability to take risks and vice versa. Apart from the factors mentioned above, net worth is an essential factor in determining the overall risk tolerance of the portfolio. An individual with a higher net worth tends to have a higher ability to take the risk.

The risk profile constitutes the willingness and the ability to take the risk. The investment plan of any investor should be based on their overall risk profile.

Risk Ability vs Risk tolerance

Risk ability is the capacity of the investor to take risk. Risk tolerance would mean psychological willingness to take the risk. It is the amount of loss that an investor is ready to handle in his portfolio before deciding to sell the security.

Risk tolerance is a factor that the investor decides based on his needs, expectations and experience. In contrast, the ability to take risk shall be determined by the financial adviser considering all other external as well as internal factors.

For eg.: An young investor would be willing to take the risk since age is on his side. However, he would not have sufficient capital to absorb such high willingness to take the risk. Therefore, the ability to take risk is much lower. The overall risk profile of the investor, in this case, could be understood as conservative to moderate.

The critical factor in deciding the risk tolerance of an investor should be the resistance or comfort to handle the volatility and the potential initial losses if any, in the portfolio.

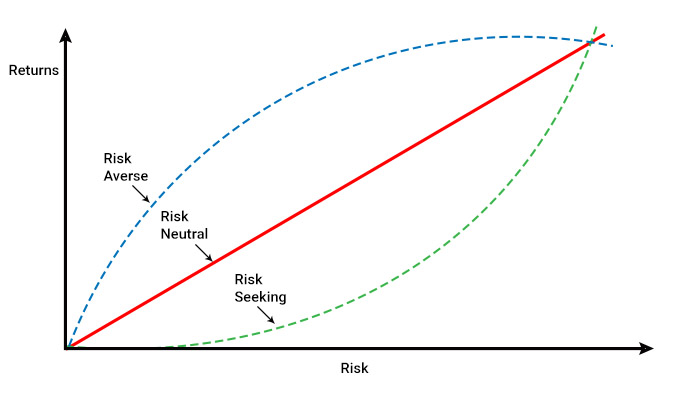

- Based on the risk tolerance criteria, there are three types of investor classification:1. Aggressive Risk Tolerance – Generally, investors with a higher risk tolerance tend to have a deeper understanding of the financial markets and are generally risk-takers, i.e. risk seekers. They would be preferring investing in high-risk security even with a little probability of returns as well.

- Moderate Risk Tolerance – Such investors have a balanced approach to risk tolerance. A single unit of return motivates them to increase a unit of risk as well. Their portfolio would generally combine safe blue-chip securities along with small-cap high volatile stocks to have a balance risk tolerance.

- Conservative Risk Tolerance – Newbie investors generally fall within this category who are sceptical about investing and would prefer a lower risk of the overall portfolio. They would demand more units of returns even for a single unit of marginal risk.

It is very important to understand the fundamental difference between risk capacity and risk tolerance. Both risk capacity and risk tolerance are crucial to define the risk profile of the investor as they’re crucial to determine the asset allocation and percentage exposure to different asset classes.

Through risk management, one could measure the goals and can prevent unwanted surprises in the future and feel a higher level of comfort to reach his financial goals successfully.